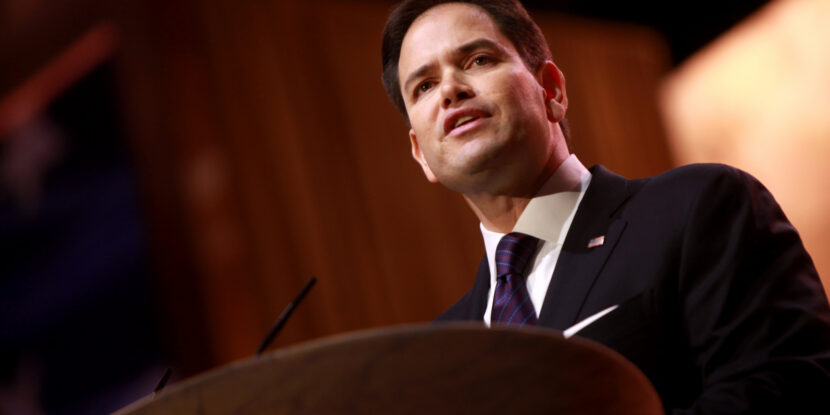

The Rubio announcement of candidacy on Monday (April 13) was frustrating for its lack of policy substance, the “what and how” that would define his presidency. He seems intent on basing his candidacy on a personal narrative.

In particular, what does Senator Rubio have to say to voters blindsided by the recession of 2007, who suffered through 2008 and the ensuing anemic recovery and are suffering still today as the buying power of their family income steady erodes? To them, he said (in his announcement),“If we reform our tax code and reduce regulations and control spending and modernize our immigration laws and repeal or replace Obamacare – if we do these things … if we do these things, the American people will create millions of better paying modern jobs.” But there the argument stops.

To be fair, Senators Rubio and Mike Lee had previously proposed a tax reform plan (unmentioned by Rubio in his announcement) which the two Senators defended at the Heritage Foundation this week (April 15, 2015). To the extent Lee-Rubio is the foundation of candidate Rubio’s intended fiscal policy, it will be an albatross hung around his neck. The essential problem is that Lee-Rubio is a corporate tax cut hiding behind the patina of individual tax relief which violates key principles of tax equity and politically-successful tax reform.

Amity Shlaes and Matthew Denhart wrote in The Wall Street Journal, “[Supply-side economics or Reaganomics] treats even individual wage earners as entrepreneurs. The marginal rate to which a worker is subject under the progressive tax schedule is crucial.”

Lee-Rubio reduces the number of individual tax brackets from 7 to 2, 15% and 35%. This represents an economically trivial reduction in the top rate from the current 39.6%. But this new top rate would kick in at $75,000 for an individual filer, versus the current $406,750. So single taxpayers claiming the standard deduction would see a tax increase if earning under $51,000, or between $127,000 and $618,000, above which taxes fall. Thus, a) it is too complicated to be politically attractive (compare to Reagan’s “30% across-the-board cut in income tax rates”); b) not all taxpayers experience a tax rate reduction; and c) there is no economic stimulative effect, so this cannot be construed as a growth strategy.

Additionally, Lee-Rubio cut out all deductions except for mortgage interest and charitable contributions, thereby increasing the number of taxpayers who experience a tax increase. Then there is the “conservative social engineering” provision of a $2,500 per child tax credit. “It’s not a tax expenditure, it’s not a subsidy” Mike Lee argues,“it’s removing a penalty.” Whatever it is, the child tax credit is not an economic growth strategy.

On the corporate side, Lee-Rubio is much more generous. It reduces the corporate tax rate to 25% from a high of 39%, and extends this rate to business income declared on individual returns. It also zeroes out the capital gains tax, and eliminates the double taxation of dividends. This is a windfall for individuals who derive most of their income from property, as opposed to labor – also known as Republicans.

The problem here is that a cut in corporate income tax rates is not as defensible as being economically stimulative, and so is not self-evidently a growth strategy by means of which “millions of better paying modern jobs” will be created. Second, it will tax property income at a far lower rate than labor income. The principal of parity between labor and property income taxation goes back to Abraham Lincoln. Both rates should be as low as possible, but one should not be lower than the other.

John Mueller – director of the Economics and Ethics Program at the Ethics and Public Policy Center and an economist with a keen sensitivity to the family effects of tax policy – and Lewis Lehrman wrote in The Weekly Standard that “once the GOP shifted its ideal from taxing labor and property income equally to shifting the burden of government onto labor income, the party’s presidential candidates lost the support of independent voters and Reagan Democrats.”

Mr. Mueller wrote this to me (and is quoted with his permission): “I admire both Senators Lee and Rubio, and in many ways Senator Rubio resembles my one time boss, Jack Kemp. But I think despite some positive features his tax plan will prevent Senator Rubio from becoming president. Zeroing out the taxation of property income through expensing and abolishing the tax on capital gains will make it too easy for opponents like Hillary Clinton to make mincemeat of the plan. And he winds up with a 35% top rate, higher than the 28% we had after the tax reform of 1986.”

2016 is an election with a profoundly disaffected electorate. The succession of a two-term president by someone of his own party is historically extremely rare, virtually unheard of when the two-term president is unsuccessful. The liberal experiment of Obama and Clinton has failed. The only thing which can resuscitate Hillary Clinton’s electoral prospects will be a Republican candidate who caters more to the interests of the rich than to the concerns of a still suffering middle class.

Steve Wagner is the founder and president of QEV Analytics, a Washington DC-based public opinion research firm.