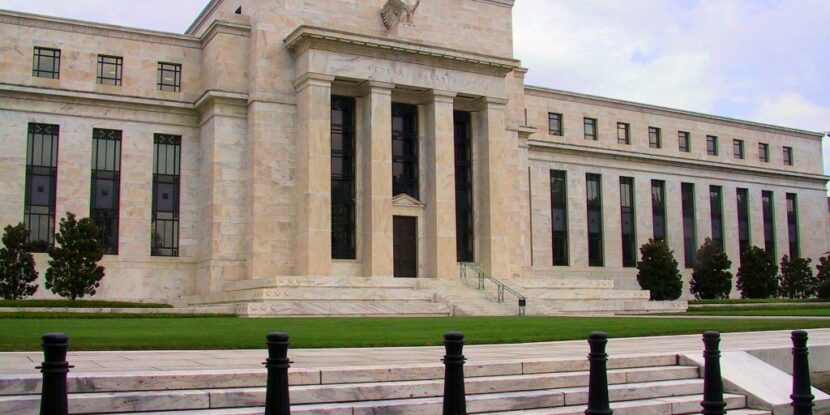

In his post earlier this week on Chris Christie’s tax reform remarks in New Hampshire, Steve Wagner drew attention to some interesting comments the governor made on the Federal Reserve. To wit:

The Fed’s easy money policies and the president’s anti-growth policies have made the rich even richer and made our middle class work longer and harder for less pay and less promise for their future.

Steve writes that Christie’s criticism of the Fed may have been motivated by his sensing an opportunity to seize on the issue, given other candidates’ lack of attention to it. This may very well be the case. However, intentionally or not, Christie may also have put his finger on the most important economic issue affecting the middle class which is not (as yet) being widely discussed this campaign cycle.

On Wednesday, Dr. Judy Shelton, an Atlas Network senior fellow, wrote a column for The Hill validating Christie’s Fed claims with some rather compelling observations:

It’s been nearly six years since the recession officially ended in June 2009. Still, the Fed continues to pursue its zero-interest-rate policy in the name of supporting the recovery, even as the negative aspects of this approach are imposing significant economic costs.

According to a report issued in March by Swiss Re, the world’s second-largest reinsurance company, the Fed’s policy of financial repression has cost U.S. savers roughly $470 billion in lost interest income. Other unintended consequences described in the report include “crowding out viable private markets” and “lowering the funds available from long-term investors to be used for the real economy.”

[…]

So in crafting its monetary strategy to stimulate economic growth, it seems the Fed has given short shrift to the middle-income Americans who fuel the private sector — the true engine of productive economic growth. How much has consumer demand decreased because personal savings accounts pay zilch? How much has employment and production suffered because entrepreneurs can’t get loans from their local banks?

Yet, even as business investment languishes and manufacturing has hit the skids, and with America’s annual growth rate coming to a near halt at 0.2 percent for this year’s first quarter, our monetary authorities seem clueless about the impact of their own policies…

As Dr. Shelton notes, there are good reasons to suspect that Fed policies have not helped, and have even set back, the middle class in the U.S. Gov. Christie is correct to call attention to the role Fed policies have played in perpetuating the stagnant economic status quo, and one hopes he will not be the only 2016 candidate to do so.

Paul Dupont is a legislative assistant for American Principles in Action.