Last week, House Republicans quietly abandoned basic tenets of supply-side economics by releasing a tax plan that includes higher marginal rates.

While it was assumed the House GOP would prioritize corporate tax reform over individuals (prevailing economic models show corporate tax cuts give us the most bang-for-our-buck in economic growth), the idea that many Americans will actually face a higher tax rate in order to pay for corporate rate reduction is an unwelcome surprise.

Under the House GOP plan, Americans currently subject to a 33 percent income tax rate will be bumped up to a 35 percent rate. A two-percent marginal rate hike may sound trivial, but keep in mind this amounts to a roughly 6 percent increase from what these filers currently pay. Compound this with eliminating the state income tax deduction, capping the property tax deduction, and capping the mortgage interest deduction, and you are left with a plan that leaves many Americans with a significantly higher bill from Uncle Sam.

That’s not to say that Republicans should avoid eliminating or restricting deductions — but it should be done commensurately with lower rates to minimize (or preferably eliminate) the financial pain. “Do No Harm” should be a guiding principle when crafting a tax bill, but the House GOP failed this test by cutting deductions and raising rates — a double whammy for many American taxpayers.

In addition to the 33-percenters, some individuals in the top bracket will also face higher marginal rates, close to 50 percent, as a result of the House GOP’s “bubble tax.” As The Wall Street Journal noted:

You know Republicans are intellectually confused when they send out press releases defending a top marginal income-tax rate of nearly 50%. Yet that’s what they were up to this weekend as they tried to justify their bubble bracket tax rate of 45.6% after our criticism on Saturday.

The 45.6% is a bubble rate because it applies to tax-filing couples who make between $1.2 million and $1.6 million (above $1 million for single filers)…

Add that to the 3.8% ObamaCare surcharge that Republicans are keeping as part of tax reform, and these taxpayers would now have a top marginal rate of 49.4%. Add state and local taxes, which would no longer be deductible against federal taxes (a policy we support), and these mostly Republican voters would in many states pay a marginal rate (on the next dollar of income) close to 60% and an effective rate (total share of income) higher than they do now. Keep in mind this is Republican tax policy.

Ironically, although the House plan significantly attacks American universities, this bill has all the makings of something cooked up on an academic’s chalkboard. The plan’s authors reveal a militant devotion to squeezing every dollar politically feasible from individual filers to further lower corporate rates, believing this will prove better for overall economic growth.

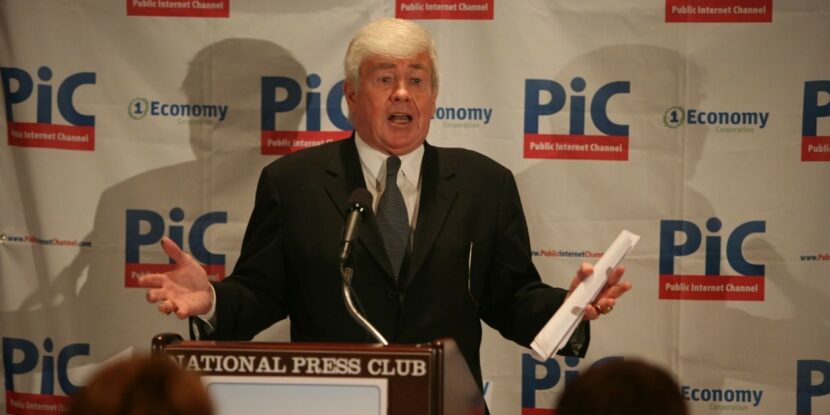

But as supply-side founder Jack Kemp has shown us, House Republicans are likely underestimating the economic impact of increasing marginal tax rates. In crafting Reagan’s 1981 Economic Recovery Tax Act (ERTA), Kemp emphasized the importance of cutting marginal tax rates for everyone. As the History Channel states:

The ERTA included a 25 percent reduction in marginal tax rates for individuals, phased in over three years, and indexed for inflation from that point on. The marginal tax rate, or the tax rate on the last dollar earned, was considered more important to economic activity than the average tax rate (total tax paid as a percentage of income earned), as it affected income earned through “extra” activities such as education, entrepreneurship or investment. Reducing marginal tax rates, the theory went, would help the economy grow faster through such extra efforts by individuals and businesses. The 1981 act, combined with another major tax reform act in 1986, cut marginal tax rates on high-income taxpayers from 70 percent to around 30 percent, and would be the defining economic legacy of Reagan’s presidency.

Jack Kemp also stressed the importance of lowering marginal tax rates (even as Reagan’s advisors pushed for merely enacting tax relief) because he understood how inflation can impact ones tax bracket. As Morton Kondracke and Fred Barnes wrote in their iconic biography Jack Kemp: The Bleeding-Heart Conservative Who Changed America:

The pro-Kemp-Roth witness said that inflation had pushed taxpayers into higher and higher brackets, forcing them to pay ever-higher marginal tax rates – the rate on the next dollar they earned. In 1965, they pointed out, only 18.8 percent of taxpayers were paying marginal rates of 20 percent or more. By 1975, it was 53.3 percent, leading to a serious erosion of incentives to work and invest. And without Kemp-Roth, taxes would continue to rise.

The idea — and importance — of marginal tax rates was something Kemp had to explain again and again. He may have done it most clearly in a Fortune interview: ‘Let’s say your income is taxed 10 percent on Monday, 20 percent on Tuesday, 30 percent on Wednesday, 40 percent on Thursday, 50 percent on Friday and so on. For most people, sometime around Friday, you’d decide not to work anymore.’ Inflation and ‘bracket creep were systematically and inexorably pushing middle-income workers toward Friday levels of tax.’

The “bracket creep” that Kemp warned of raises more red flags against the House GOP’s tax plan, which includes a less-generous formula for calculating cost-of-living increases on individual brackets.

The House GOP’s abandonment of Kemp-style rate cuts in favor of their academic growth formula begs one to ask “if it ain’t broke, why fix it?” As Ralph Benko noted in Forbes.com:

Rep. Jack Kemp confronted the economic stagnation of his day by inverting the conventional economic policy of high tax rates and “easy money” to low tax rates and stable monetary policy, Supply-Side Economics. This proposition was initially ridiculed but Kemp crusaded on it fearlessly and tirelessly. It was eventually taken up by Reagan, and then by other international leaders, propelling the world GDP from $10T to $73T.

The Kemp Playbook — including marginal tax rate reductions for all — caused a rising tide that lifted all boats. This is the formula the House GOP should replicate for America.

Photo credit: a.bonner via Flickr, CC BY-SA 2.0