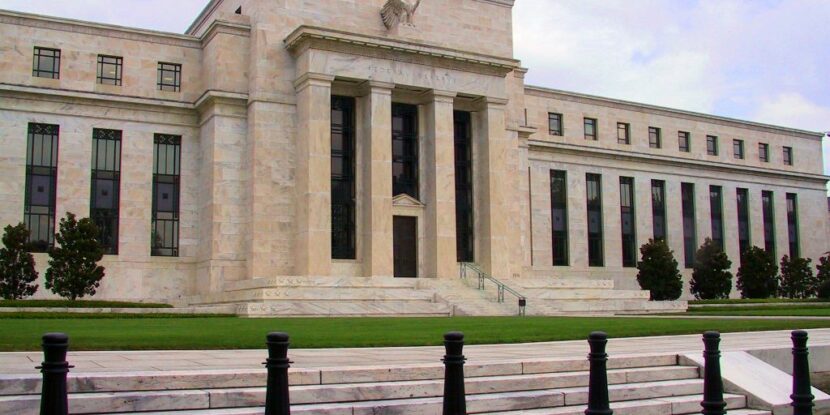

Sen. Rand Paul and a co-author, on the occasion of today’s FOMC meeting and the morning before the second presidential debate, took to The Wall Street Journal editorial page to demand that the Fed stop meddling in the setting of interest rates. (His short term prediction for the outcome of this admittedly presents as at least somewhat dire.)

It would be very refreshing were CNN’s moderators to give prominence to questions about the economy, job creation, and the candidates’ proposed remedies for the ongoing sluggishness in the economy. That said, CNN should resist the temptation to perseverate on the candidates’ respective tax proposals.

Reaganomics, which vanquished a towering Misery Index and restored job growth, had not one but two components. While his Kemp-Roth across-the-board tax rate cuts received most of the political and public attention, the blueprint for Reaganomics gave equal weight to restoring good monetary policy. Under Reagan’s aegis, Fed Chairman Paul Volcker did just that.

Double digit inflation no longer is the presenting problem. But bad money can manifest in a number of ways. The current dramatic fall in commodities prices, and the dramatic rise of the dollar against the currencies of our trading partners, clearly is a result of Fed policy. It is a deeply worrisome one, contrary to the Fed’s price stability mandate.

It could prove the “sleeper issue” of the 2016 race. By grilling each of the candidates about where they stand in the Fed — and about the Brady-Cornyn monetary commission that Sens. Paul and Cruz have co-sponsored — Jake Tapper could open up a really key issue set that so far has gone deeply under-reported.

The Fed, and getting monetary policy right, is as key to restoring a climate of equitable prosperity now as it was in Carter’s, and then Reagan’s day.

Let’s hear what the candidates have to say about the Fed!

Ralph Benko, internationally published weekly columnist, co-author of The 21st Century Gold Standard, lead co-editor of the Gerald Malsbary translation from Latin to English of Copernicus’s Essay on Money, is American Principles in Action’s Senior Advisor, Economics.