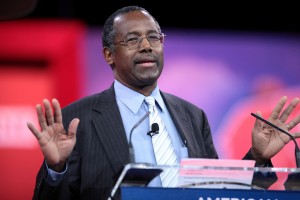

With all the recent criticism heaped on the Federal Reserve by Republican candidates, I suppose a media backlash was inevitable. Timothy Lee, writing for Vox, has attacked Dr. Ben Carson’s comments that the Fed’s zero-interest-rate policy hurts savers. He didn’t do this by disputing Carson’s claim, but by saying that it’s more important for the middle class to be able to borrow than to save:

The most obvious problem with the Nader and Carson arguments is that they ignore the fact that ordinary people don’t just save money, they borrow it too. If you’ve bought a house in the past few years, you probably benefited from today’s exceptionally low interest rates. If you bought a house 10 or 20 years ago, you probably benefited from being able to refinance your mortgage in the past few years. That’s thousands of dollars in lost income for the big banks Nader loathes so much.

“If you’ve bought a house”? Let’s leave aside the fact that homeownership is at a 40-year low and ask: how many Americans are actually borrowing money? It might be nice to have lower interest rates when one buys a first car, or when trying to start a business, but the best way to make sure the banks lose income is to pay off the full amount as soon as one can. Furthermore, the 90 percent of Americans that don’t own a business don’t need the kind of loans Lee is talking about.

Low interest rates might be good for a small minority of Americans, but for everyday life, Ben Carson’s claim that the current Fed policy hurts the middle class is right on the money.

Nick Arnold is a researcher for the American Principles Project.