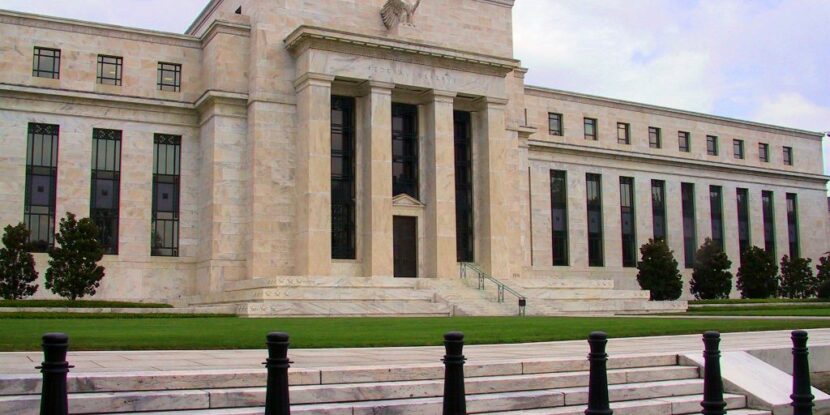

Last week at The American Spectator, Bob Luddy aimed some harsh criticism at the Federal Reserve, blaming the Fed’s policy of keeping interest rates artificially low with causing a decline in the value of the dollar and undermining economic growth:

The Federal Reserve Bank, commonly referred to as “The Fed,” has a policy to inflate the dollar by 2% annually. This is an absurd policy, which undermines our currency. The methods the Fed uses to achieve this policy distort and undermine sustainable economic growth.

The Fed was established in 1913 as the Central Bank of the United States, for the purpose of maintaining a stable banking system and supporting sound money. But the opposite has happened. Since the founding of the Fed, the dollar has lost more than 90% of its value.

The Fed manipulates the money supply with artificially low interest rates to create inflation. This policy enables the federal government to expand deficit spending without the penalty of market interest rates. But interest is a cost that is important to sound business calculations; a sound economy requires financial reality.

By manipulating rates, the Fed undermines all economic decisions and creates market distortions. This manipulation results in economic bubbles that are challenging to detect, until it’s too late.

[…]

You can read the full article here.

Paul Dupont is the managing editor for ThePulse2016.com.