President Donald J. Trump is issuing an order to impose reciprocal tariffs on foreign nations that have already instituted their own tariffs on American exports. The proposed tariffs aim to end unfair trade practices that tilt international markets against American companies and products, an issue that President Trump has repeatedly emphasized for decades and argues has undermined both the national interest and the United States economy.

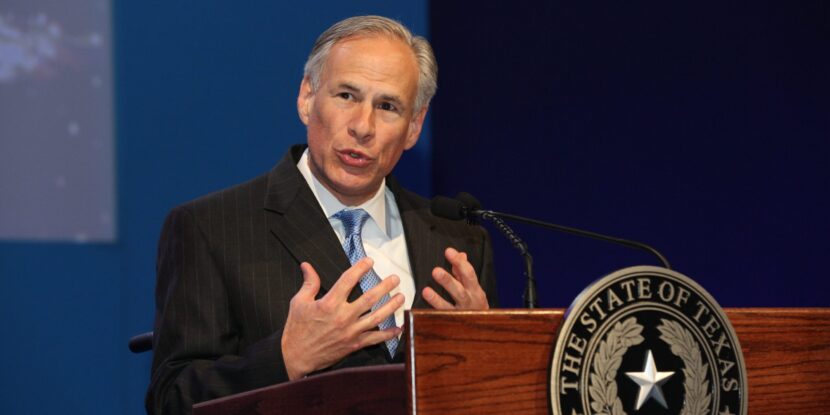

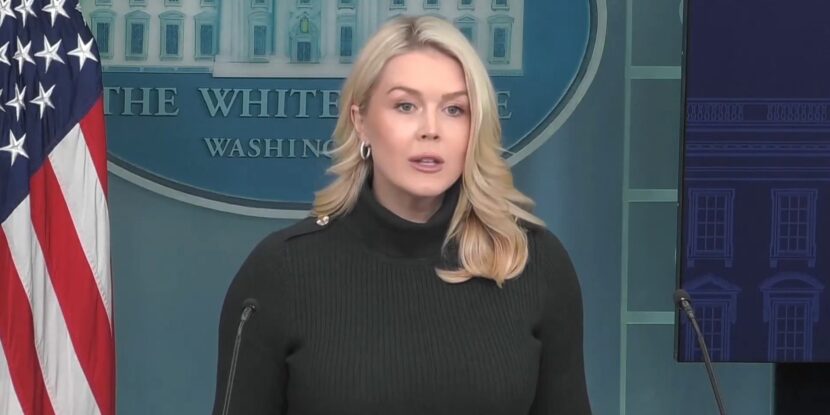

“On trade, I have decided for purposes of fairness that I will charge a reciprocal tariff—meaning whatever countries charge the United States of America, we will charge them. No more, no less,” Trump said during a Thursday press conference at the White House. He continued: “In other words, they charge us a tax or tariff and we charge them the exact same tax or tariff. In almost all cases, they’re charging us vastly more than we change them. But those days are over.”

President @realDonaldTrump announces RECIPROCAL TARRIFFS! 🇺🇸 pic.twitter.com/3gdw11RkC6

— Margo Martin (@MargoMartin47) February 13, 2025

Notably, Trump says he intends to impose tariffs on countries that have enacted a Value Added Tax (VAT). The European Union’s member states, which use a stringent VAT system, would be the most prominently impacted countries.

Once enacted, the tariffs will target a wide range of goods—though automobiles, manufacturing, and raw industrial materials are among the most prominent products targeted. Already, President Trump has instituted a new 10 percent tariff on goods from China and initiated—but paused—tariffs of 25 percent on goods imported from Mexico and Canada; the latter tariffs are intended to push Canada and Mexico to crack down on drug trafficking across their borders with the U.S.

Critics of President Trump’s tariff plans claim their imposition will increase prices for American consumers. However, The National Pulse has previously detailed that this claim is—for the most part—untrue. Tariffs are paid by the importing company on the cost of the product or good at the point of production. This means a 25 percent tariff—for instance—is on the price at the point of production and not on the sale price consumers see.

Additionally, reciprocal tariffs are intended to level the playing field in international trade by matching import taxes foreign nations have already imposed on U.S. exports.