PULSE POINTS:

❓What Happened: President Donald J. Trump is urging Congress to pass a comprehensive bill aimed at implementing major tax cuts. The move comes as the America First leader appears to be refocusing his White House on critical domestic and economic issues, having expressed frustration with the lack of progress in U.S. mediation of the Russia-Ukraine war.

👥 Who’s Involved: President Donald J. Trump, U.S. Congress.

📍 Where & When: President Trump ramped up pressure on Congress to finalize and pass a reconciliation bill providing tax relief Tuesday night at a rally in Michigan.

💬 Key Quote: “In the coming weeks and months, we will pass the largest tax cuts in American History—and that will include No Tax on Tips, NO Tax on Social Security, and No Tax on Overtime. It’s called the one big beautiful bill,” President Trump said.

⚠️ Impact: The proposal could increase real wages by up to $3,300 annually, boost take-home pay for median-income households by up to $5,000 per year, elevate short-run GDP by 3.3-3.8 percent and long-term GDP by 2.6-3.2 percent, and preserve 4.1 million jobs.

IN FULL:

President Donald J. Trump appears to be refocusing his administration to tackle key domestic policy issues, as a solution to end the Russia-Ukraine war continues to be elusive. The America First leader, speaking at a rally Tuesday night in Michigan, called on lawmakers on Capitol Hill to work to pass a reconciliation bill that will implement his proposed overhaul of the U.S. tax code and make the 2017 Trump tax cuts—the Tax Cuts and Jobs Act (TCJA)—permanent.

“In the coming weeks and months, we will pass the largest tax cuts in American History—and that will include No Tax on Tips, NO Tax on Social Security, and No Tax on Overtime. It’s called the one big beautiful bill,” President Trump declared. The proposal aims to provide substantial tax reductions, touted as the largest in history, for the American populace.

The tax overhaul includes noteworthy provisions to exempt tips, overtime, and Social Security for seniors from taxation. Additionally, the Trump White House contends the proposal will increase real wages by as much as $3,300 per year, with median-income households potentially seeing up to $5,000 more in take-home pay annually.

Meanwhile, President Trump’s economic team argues that the tax cuts will have an extensive impact on the U.S. economy. According to the White House’s Council of Economic Advisors (CEA), the permanence of the 2017 tax cuts could result in an uptick in short-run real GDP between 3.3 and 3.8 percent. The long-run effects are anticipated to boost GDP by 2.6 to 3.2 percent. The CEA analysis also projects that the tax plan could save a total of 4.1 million jobs, offering a substantial economic safety net.

Earlier this year, the U.S. House of Representatives and Senate adopted respective budget resolutions, kick-starting the budget reconciliation process. This bill will serve as the vehicle for President Trump’s tax overhaul. Notably, reconciliation bills cannot be filibustered in the Senate, meaning Congressional Democrats have few procedural tools to delay or stop the legislation.

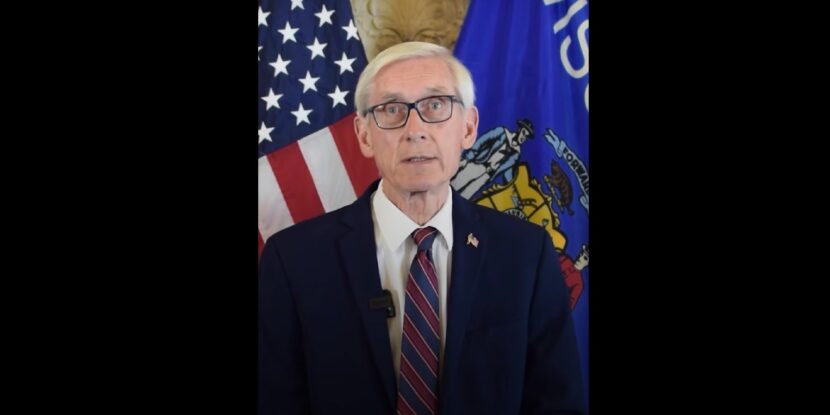

WATCH:

.@POTUS: “In the coming weeks and months, we will pass the largest tax cuts in American History—and that will include No Tax on Tips, NO Tax on Social Security, and No Tax on Overtime. It’s called the one big beautiful bill…” pic.twitter.com/SRwaWoY9gZ

— Rapid Response 47 (@RapidResponse47) April 29, 2025