PULSE POINTS:

❓What Happened: Home Depot reiterated its full-year sales forecast and announced it would not raise prices in response to tariffs.

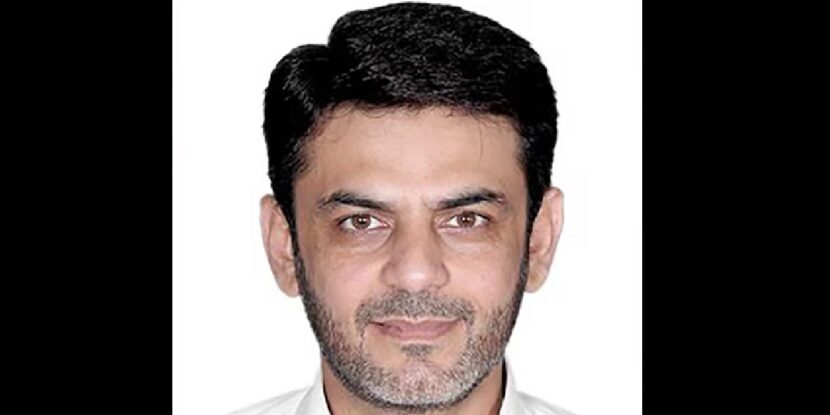

👥 Who’s Involved: Home Depot, Chief Financial Officer Richard McPhail, U.S. consumers, suppliers.

📍 Where & When: United States, fiscal first quarter ending May 4.

💬 Key Quote: “We intend to generally maintain our current pricing levels across our portfolio,” said CFO Richard McPhail.

⚠️ Impact: Home Depot’s pricing strategy contrasts with competitors like Walmart, and the company reported muted sales growth amid a tough housing environment.

IN FULL:

Home Depot announced on Tuesday that it will maintain its current pricing strategy despite claims that President Donald J. Trump’s tariffs could result in higher retail costs for consumers, citing strong supplier relationships and operational efficiency. Chief Financial Officer (CFO) Richard McPhail said that the company’s scale and partnerships would allow it to avoid price hikes.

“Because of our scale, the great partnerships we have with our suppliers and productivity that we continue to drive in our business, we intend to generally maintain our current pricing levels across our portfolio,” McPhail said during an interview with CNBC on Tuesday morning.

The Home Depot CFO noted earlier on Tuesday, during a company earnings call, that the tariffs provided an opportunity for the massive hardware and supply retailer to expand its market share against competitors. “It’s a great opportunity for us to take share, and it’s a great opportunity for our suppliers to take share as well,” he said.

McPhail highlighted that over half of Home Depot’s products are sourced domestically. Additionally, the company has diversified its import sources, reducing reliance on China. By next year, no single country outside the U.S. will account for more than 10 percent of its purchases, according to McPhail.

The announcement coincided with the release of Home Depot’s fiscal first-quarter results. The company missed Wall Street’s earnings expectations for the first time since May 2020 but exceeded sales forecasts. Net income for the quarter, ending May 4, stood at $3.43 billion, or $3.45 per share, down from $3.60 billion, or $3.63 per share, a year earlier. Total sales grew 2.8 percent year over year, bolstered by the acquisition of SRS Distribution, a supplier for home professionals.

Home Depot CEO Ted Decker, on the same earnings call, contended that the slower sales were because of “stubbornly high” interest rates, laying the blame at the feet of the Jerome Powell’s Federal Reserve—though he did not name the central bank directly.

Comparable sales fell 0.3 percent during the quarter, with U.S. comparable sales increasing slightly by 0.2 percent. McPhail attributed February’s decline to poor weather but noted that sales improved in March and April, with the latter seeing a 1.8 percent year-over-year increase. The company also reported a 2.1 percent rise in customer transactions, with an average ticket of $90.71.

Notably, McPhail’s comments add further evidence to the argument that many companies will attempt to maintain current price levels or mitigate increases as much as possible to maintain their market share. This appears to be especially true for suppliers and U.S. retailers who are considering shifting or even eliminating product sourcing in China.