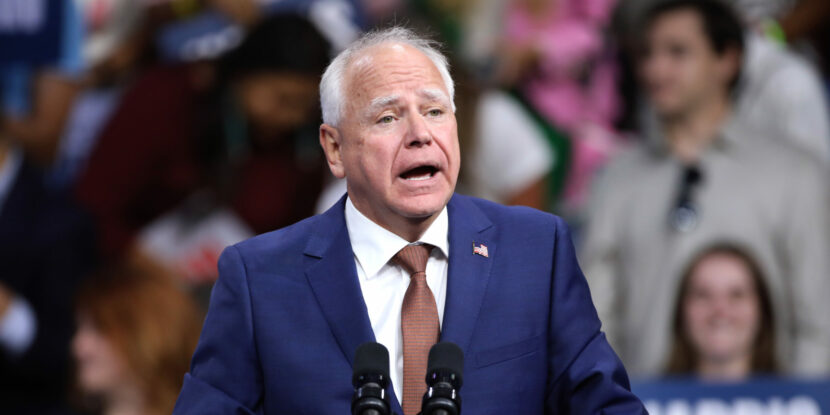

❓WHAT HAPPENED: The U.S. Federal Housing Finance Agency filed a criminal referral against Sen. Adam Schiff, alleging violations of federal laws tied to mortgage and tax fraud.

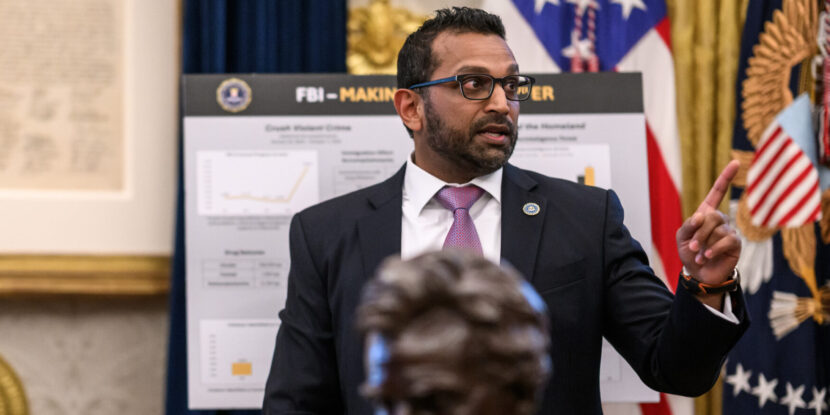

👤WHO WAS INVOLVED: Sen. Adam Schiff (D-CA), Director William Pulte of the Federal Housing Finance Agency, and Attorney General Pam Bondi.

📍WHEN & WHERE: The referral, detailing actions spanning from 2003 to 2019, was sent to the Justice Department and covered properties in Maryland and California.

💬KEY QUOTE: “Based on media reports, Mr. Adam B. Schiff has, in multiple instances, falsified bank documents and property records to acquire more favorable loan terms, impacting payments from 2003–2019 for a Potomac, Maryland-based property.” – William Pulte

🎯IMPACT: Schiff faces potential penalties, including up to 20 years in prison and $250,000 in fines, if charged and convicted.

A criminal referral submitted by William Pulte, Director of the U.S. Federal Housing Finance Agency (FHFA), to Attorney General Pam Bondi, accuses Sen. Adam Schiff (D-CA) of possibly violating multiple federal statutes, including wire fraud, mail fraud, bank fraud, and making false statements to financial institutions.

According to a report published on July 17, Pulte’s referral is based on findings from Fannie Mae financial crimes investigators and outlines what he describes as a “pattern of possible occupancy misrepresentation” connected to Schiff’s handling of real estate holdings in Maryland and California from 2003 to 2019.

“Based on media reports, Mr. Adam B. Schiff has, in multiple instances, falsified bank documents and property records to acquire more favorable loan terms, impacting payments from 2003–2019 for a Potomac, Maryland-based property,” Pulte wrote in the referral.

At the center of the allegations is Schiff’s repeated declaration of both his California and Maryland residences as “primary residences” on mortgage applications. This move would violate federal rules permitting only one primary residence designation at a time. The referral cites instances in 2009, 2011, and 2013 where Schiff refinanced his Maryland home while simultaneously identifying a California condominium as his principal residence.

According to the referral, this dual-claim arrangement was not corrected until 2020, when Schiff reclassified the Maryland property as a secondary residence.

“Primary residence mortgages receive more favorable loan terms, including lower interest rates, than secondary residence mortgages,” Pulte stated in the referral. He further alleged that Schiff financially benefited from these misrepresentations through more advantageous refinancing rates and a property tax reduction on his California home totaling approximately $7,000.

The referral also draws broader connections between Schiff’s alleged misconduct and ongoing concerns about mortgage fraud involving Democratic Party officials. It references explicitly related allegations involving New York Attorney General Letitia James.

Join Pulse+ to comment below, and receive exclusive e-mail analyses.