❓WHAT HAPPENED: The U.S. signed an “economic stabilization agreement” with Argentina’s central bank, involving a $20 billion currency swap.

👤WHO WAS INVOLVED: Treasury Secretary Scott Bessent, President Donald J. Trump, and Argentina’s President Javier Milei.

📍WHEN & WHERE: Announced Tuesday, October 21, 2025, in the United States and Argentina.

💬KEY QUOTE: “We do not want another failed state in Latin America, and a strong, stable Argentina as a good neighbor is explicitly in the strategic interest of the United States.” – Secretary Bessent

🎯IMPACT: The agreement aims to stabilize Argentina’s currency and economy, heading off a potential broader regional economic crisis.

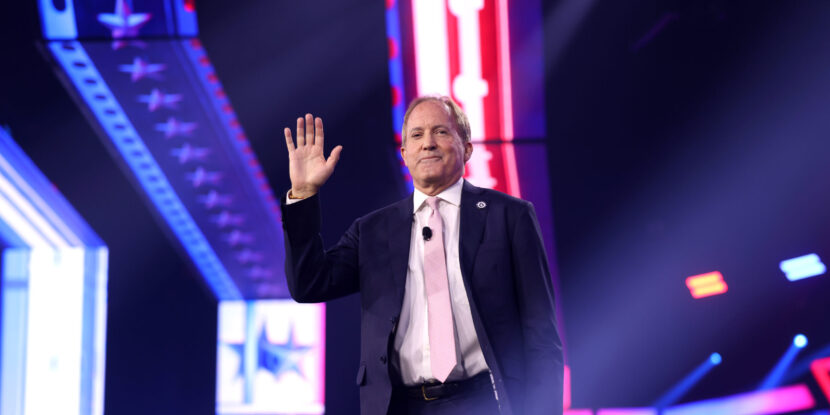

On Tuesday, U.S. Treasury Secretary Scott Bessent confirmed that the Trump administration has entered into an “economic stabilization agreement” with Argentina’s central bank. The agreement is a key element of President Donald J. Trump’s effort to aid Argentina with a multibillion-dollar rescue plan.

The agreement, announced by Argentina’s central bank on Monday, involves a $20 billion currency swap designed to support the Argentine peso, as the nation approaches important midterm elections. These elections are crucial for the political future of President Javier Milei, a key South American ally of the Trump administration.

Earlier this month, President Trump and Secretary Bessent pledged substantial support to stabilize Argentina’s economy and currency. The Treasury Department has already taken steps to purchase Argentine pesos directly as part of this effort.

Despite criticism from Democrats and some conservatives who view the aid as a bailout for a foreign nation, Bessent stated, “Argentina now has the opportunity to embrace economic freedom, and our stabilization agreement is a bridge to a better economic future for Argentina, not a bailout.” He emphasized the strategic importance of a stable Argentina for the United States.

“We do not want another failed state in Latin America, and a strong, stable Argentina as a good neighbor is explicitly in the strategic interest of the United States,” Bessent added. Without American fiscal support, the Argentine currency crisis has the potential to spread across Latin America, throwing the region into economic turmoil—a strategic concern for the Trump White House.

In addition to the currency swap, Bessent is working on securing an additional $20 billion in financing from private lenders or sovereign wealth funds—though this financing plan has not yet been finalized.

Join Pulse+ to comment below, and receive exclusive e-mail analyses.