The U.S. House Ways and Means Committee is pushing state attorneys general to begin investigations into at least six tax-exempt organizations potentially linked to foreign terrorist activities. In a series of letters released earlier this week, Ways and Means Chairman Jason Smith (R-MO) notified officials in the states of Washington, New York, Virginia, Arizona, California, and Texas that certain organizations may be operating beyond their tax-exempt mandates, promoting antisemitism, and engaging in unlawful activities.

Chairman Smith notes that these non-profits all appear to be “operating outside their tax-exempt purpose, fueling antisemitic activities, and potentially engaging in activity that violates both state and federal law,” adding the grounds to revoke their tax-exempt status.

Among the organizations singled out is The Palestine Chronicle, a nonprofit media company in Washington State, accused of employing a Hamas operative. The operative was reportedly involved in holding Israeli hostages, leading to his death during a subsequent rescue operation.

In addition to Washington, New York’s Attorney General Letitia James (D) has been asked to look into the Westchester People’s Action Coalition and The People’s Forum. These groups stand accused of promoting antisemitism by allegedly supporting riots. Virginia’s Attorney General Jason Miyares (R) has similarly been prompted to investigate the Americans for Justice in Palestine Educational Foundation and American Muslims for Palestine for also potentially inciting riots.

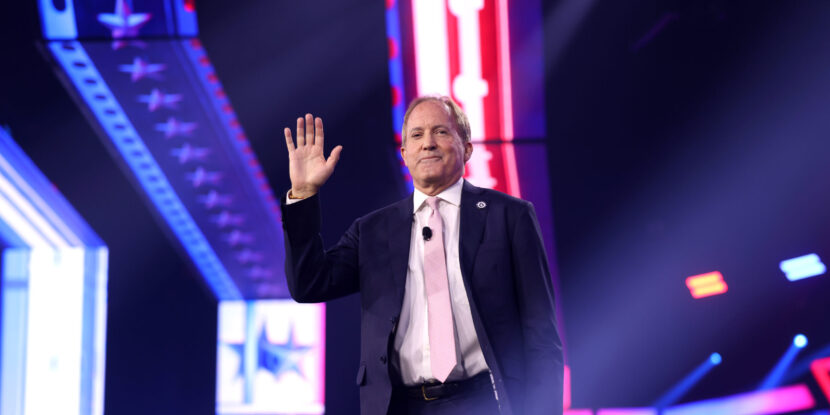

Arizona Attorney General Kris Mayes (D) received a request to pursue the Alliance for Global Justice, citing ties with Samidoun, a U.S.-designated terrorist organization. Letters sent to California Attorney General Rob Bonta (D) and Texas Attorney General Ken Paxton (R) also outlined suspicions regarding other nonprofits—including the Tides Foundation—and their possible illegal affiliations with terrorist groups.