❓WHAT HAPPENED: The Federal Reserve’s Federal Open Market Committee (FOMC) moved to cut interest rates on Wednesday by 25 basis points (bps), marking the first rate cut of 2025.

👤WHO WAS INVOLVED: The Federal Reserve, the Federal Open Market Committee (FOMC), Fed Chairman Jerome Powell, President Donald J. Trump, and the U.S. economy.

📍WHEN & WHERE: September 17, 2025, in Washington, D.C.

🎯IMPACT: While economists largely forecasted the rate cut, the decision still triggered a degree of market volatility, though this is fairly common in the wake of a reduction in rates.

The Federal Reserve’s Federal Open Market Committee (FOMC) moved to cut interest rates on Wednesday by 25 basis points (bps), marking the first rate cut of 2025. While economists largely forecasted the rate cut, the decision still triggered a degree of market volatility, with stocks initially jumping higher on the news.

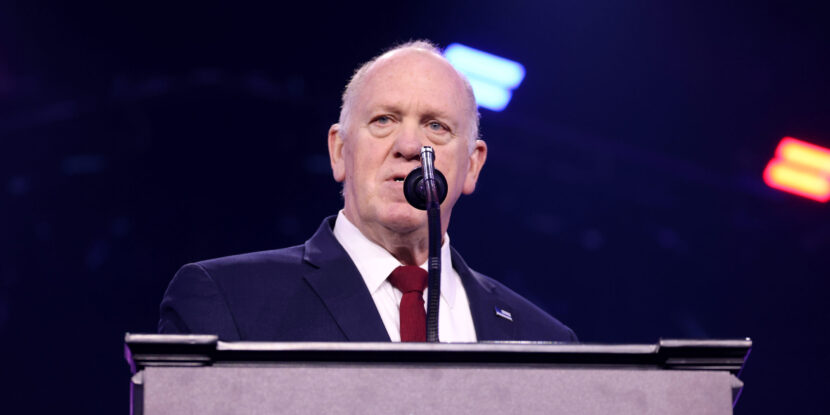

In August, during the Federal Reserve’s annual Jackson Hole summit, the central bank’s chairman, Jerome Powell, signalled that the FOMC would likely move to cut rates at its September meeting. At Jackson Hole, Powell indicated data showing a weakening labor market likely necessitated a reduction in interest rates. “[W]ith policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” Powell said.

Notably, the Bureau of Labor Statistics’ (BLS) benchmark revision, released earlier this month, revised downward the total number of jobs created between April 2024 and March 2025 by a shocking 911,000. This revision, accounting mostly for the final year of the former Biden government, means the monthly job growth number for much of 2024 stood at only 71,000 per month, instead of the initially reported average of 147,000 per month.

Additionally, the August jobs report suggests the U.S. economy could be slowing, with only 22,000 jobs added for the month—placing further pressure on the Federal Reserve to finally begin lowering borrowing costs. President Donald J. Trump has repeatedly pushed for Powell to cut rates, warning that the central bank’s hesitation risked putting the U.S. economy into a recession.

Join Pulse+ to comment below, and receive exclusive e-mail analyses.