❓WHAT HAPPENED: The government released September’s inflation report, showing a three percent rise in prices over the past year, below Wall Street’s forecast.

👤WHO WAS INVOLVED: The Bureau of Labor Statistics, Wall Street investors, and the federal government.

📍WHEN & WHERE: The report was released on Friday, October 24, 2025, after a nine-day delay caused by the government shutdown.

🎯IMPACT: Investors welcomed the news, with inflation remaining flat overall, though rising fuel and food prices remain a concern.

The government released September’s long-delayed inflation report, showing a three percent rise in prices over the past 12 months. This figure fell short of Wall Street’s forecast of 3.1 percent, sending stocks soaring at the market open.

The report was released nine days later than expected due to the government shutdown. Federal employees were temporarily called back to complete the data, which is likely the last major economic release until lawmakers finalize a budget deal.

Investors, who have spent 23 days relying on narrower economic indicators like corporate earnings and private jobs data, welcomed the report. However, September’s three percent inflation rate still marks the highest reading of 2025 so far.

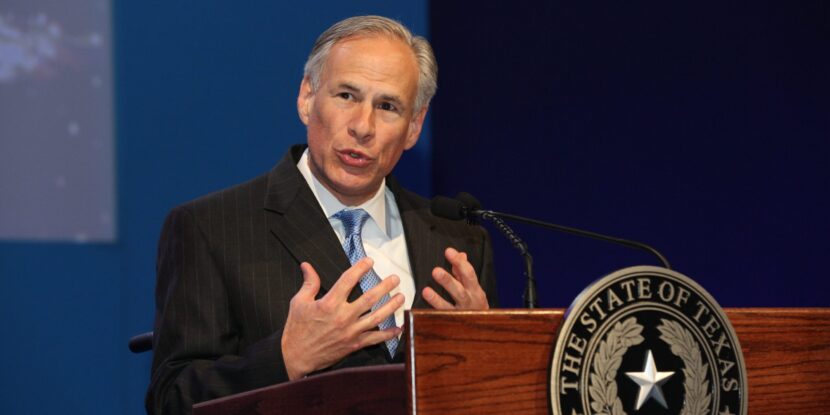

Fuel prices rose more than four percent last month and could climb further following new sanctions imposed by President Donald J. Trump on two Russian oil giants. However, gas prices at the pump are down considerably and approaching a four-year low, thanks to President Donald J. Trump moves to boost energy production and the stability in the Middle East achieved by his Gaza ceasefire deal.

Join Pulse+ to comment below, and receive exclusive e-mail analyses.