Housing affordability is one of the defining issues in American life. President Trump waxed lyrical about it from the stage at Davos this week, decrying major corporations for gobbling up U.S. housing stock.

“Homes are built for people, not for corporations, and America will not become a nation of renters,” the President told the World Economic Forum (WEF). “That’s why I have signed an executive order banning large institutional investors from buying single-family homes. It’s just not fair to the public. They’re not able to buy a house.”

The numbers are pretty grim. The frustration is palpable and widespread. The sense that the system is now rigged beyond salvation grows stronger year by year.

America’s median homebuyer is now 59 years old. That is not a functioning housing market. That is a country where adults are being shut out of homeownership.

Trump’s comments, as well as his actions, are a direct negation of the WEF’s 2016 slogan: “You’ll own nothing, and you’ll be happy.”

But one executive order and one speech do not a summer make.

If the Trump Administration wants to ratchet up its pursuit of affordability for Americans, it should take a long, hard look at another powerful actor shaping the housing market in ways most do not comprehend. It may be sitting right on your phone as you read this.

It’s Zillow.

For many, Zillow is just a harmless app where you can scroll through listings and daydream. In practice, the company has become something much bigger. Zillow is no longer just a platform that shows you what is available. It has grown into a vertically integrated housing company with its own internal ecosystem. That ecosystem now includes its own mortgage operation, called Zillow Home Loans.

Now, Zillow is not just a participant in the housing market. It has become one of the market’s gatekeepers. It can influence what buyers see, who they contact, and how quickly all these pieces can move. When a company has that kind of sway, it can shape consumer behavior without ever having to announce it.

According to a new lawsuit, that power may be getting used in a way that hurts buyers at the worst possible time, when every dollar counts.

Reuters recently reported: “Online real estate platform Zillow is facing a new consumer lawsuit in federal court in Seattle that accuses the company of pressuring homebuyers into using its mortgage lending division. The proposed class action filed on Friday, claims Zillow operates programs in which its affiliated real estate agents receive high-value sales leads only if they meet internal quotas for securing pre-approved mortgages from Zillow Home Loans.”

Now factor this into the equation: Zillow Home Loans’ mortgages cost $4,600 more than its competitors, on average.

If the allegations in the lawsuit prove accurate, they point to a system designed to steer buyers toward Zillow’s more expensive mortgage products through behind-the-scenes incentives. Agents who want access to valuable leads are pressured to meet internal targets. Buyers who think they are simply shopping for a home may be nudged toward a specific lender without realizing how the machinery is working around them.

What may seem like a minor detail is, in practice, a form of gouging American homebuyers at a critical juncture.

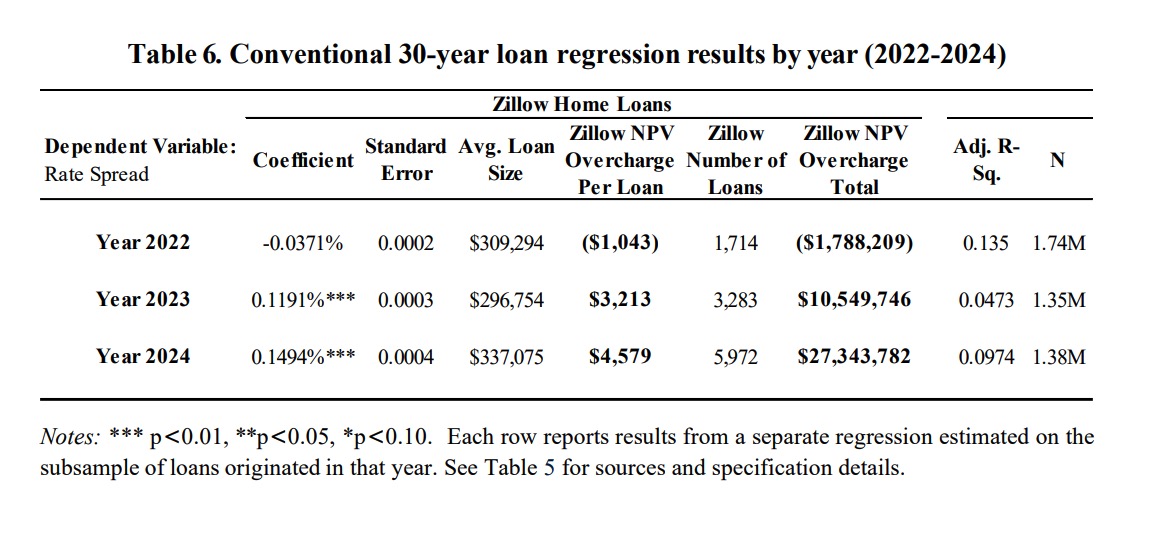

Georgetown professor Steven Salop dug into this late last year, analysing nearly 11,000 Zillow Home Loans from 2022 through 2024, and comparing them against other mortgages in the Home Mortgage Disclosure Act (HMDA) database.

He concluded: “This study provides empirical evidence that Zillow Home Loans charged higher prices than other mortgage lenders for conventional 30-year fixed-rate purchase mortgages during the three-year 2022-2024 period, after controlling for a set of borrower, loan, geographic, and temporal characteristics available in the public HMDA data.”

Zillow’s overcharge was $4,579 on an average loan size of $337,000.

That is real money for a working family. It is money that could go toward repairs, moving costs, childcare, savings, or simply staying afloat in an economy that has already punished them with higher prices across the board. It also makes it harder for buyers to compete in the first place, because every extra cost pushes the monthly payment higher and narrows the range of homes they can afford.

The study also found that veterans were hit especially hard.

For VA loans in 2024, the Zillow overcharge was $7,279 on an average loan size of $407,860. At a time when the country talks endlessly about supporting veterans, Zillow is heinously treating them as a premium revenue stream.

This is why Zillow presents such a clear opportunity for the Trump Administration.

With the President returning to his populist economic instincts this year, not only with his proposal on single-family housing but also with ideas like capping punishing credit card interest rates, the public mood is scarcely pro-corporate monopoly. Voters want someone to take on the greedy institutions that have made ordinary life more expensive and more unsettled.

The FTC and the DOJ have the authority to investigate and enforce the rules, and they should do it without hesitation.

Housing is not just another consumer product. It is the foundation of stability for families and communities. When homeownership gets pushed further out of reach, the country becomes less rooted, less secure, and less confident about the future. Americans feel that decline in their own lives, and they are done being lectured by the same people who helped create the mess.

If the goal is to restore the American Dream, then we have to Make America Affordable Again. That starts with breaking the grip of players who treat families as data points and neighborhoods as cash cows. Zillow is towards the very top of that list.

show less