Coinbase CEO Brian Armstrong said the stupid part out loud, recently opining on how the Chinese Communist Party’s (CCP) state-sponsored digital yuan will soon be paying out “interest.”

Now the central bank digital currency (CBDC) argument has to be had all over again.

Armstrong heaped praise on the CCP’s approach: “China has decided to pay interest on its own stablecoin, because it benefits ordinary people, and they recognize it as a competitive advantage.”

Alarm bells toll. The guy with all our crypto accounts at his fingertips has developed a taste for putting the blockchain in government hands. It would be bad enough if it were a U.S. central digital bank. It’s all the worse for being China.

The CCP is not running some stablecoin marketing gimmick. It is building a state-administered financial control grid. The digital yuan is a central bank digital currency in its purest form: programmable, surveilled, and designed to bring money flows closer to government oversight. Interest payments are not altruism – they are bait.

Critics online saw it immediately. One replied: “China’s version is a CBDC at best. Not a stablecoin.”

Interest-bearing digital currency changes virtually everything, by the way. The moment a token starts paying yield, it stops acting like neutral digital cash and becomes a deposit account. And deposit accounts always come with a supervisor, a regulator, a central bank, and eventually the long arm of the Federal Reserve.

Central banks have long wanted the ability to reach directly into consumer monetary behavior, to reward saving, punish spending, impose negative rates, or distribute stimulus with conditions attached. A CBDC makes that possible. The Cato Institute has warned that CBDCs could give governments sweeping power over individual financial activity, including surveillance and control that would make cash obsolete. That was never the point of the blockchain.

Bitcoin was born in the shadow of the 2008 financial crisis as a rejection of centralized monetary authority. Satoshi did not design a system in which governments could pay you interest in exchange for total visibility into your transactions. Crypto was meant to remove middlemen, not replace them with something worse.

China’s model makes the intention clear. Commercial banks are subsidizing digital yuan interest payments because adoption has lagged. The state wants citizens using the official wallet, inside the official rails, under official monitoring. And once people accept yield as the hook, they accept the architecture behind it.

In the United States, stablecoin policy is already becoming a battleground. The GENIUS Act passed in July 2025 opened the door for platforms like Coinbase to share rewards with users, and banking lobby groups are now fighting to shut it down, warning it will pull deposits out of the traditional system.

But the deeper issue is ideological. Once stablecoins become savings instruments, the distinction between private digital money and government digital money collapses. Regulators will argue that anything paying interest must be treated as a bank product. Central banks will argue that only state-issued money should carry the weight of monetary policy. The path leads in one direction.

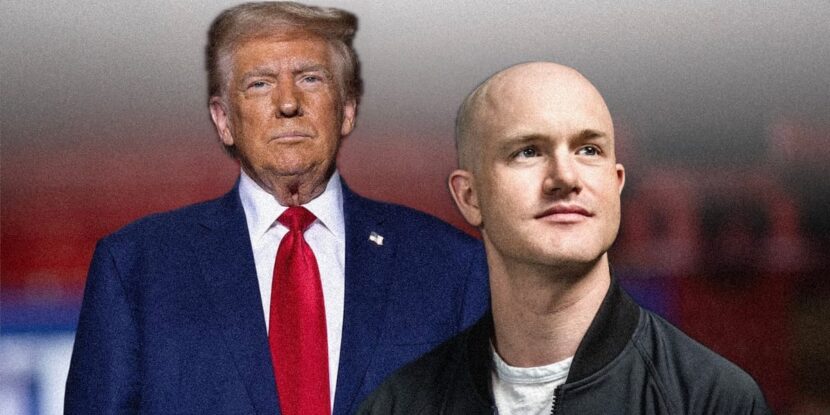

That is why President Trump, early in his second term, issued an executive order to protect Americans from the risks posed by central bank digital currencies. He was right to do it. A CBDC is not financial progress. It is financial consolidation.

Armstrong may think praising Beijing is pragmatic. It is not. China is the clearest example of what digital currency becomes when the state holds the keys: a tool of centralized power dressed up as modern convenience. The crypto industry should remember what it was built to resist.

Interest-bearing stablecoins are not the future of freedom. They are the opening act for state-run digital money.

And once that door is opened, it does not close again.