Citi’s chief economist, Andrew Hollenhorst, has forecasted a recession in mid-2024 for the U.S. economy. In a recent interview with CNBC, Hollenhorst highlighted elements in recent economic data that suggest an impending downturn. Despite apparent low unemployment, stronger consumer spending, and GDP growth, Hollenhorst warns that there are indications of economic instability beneath the surface.

“There’s this very powerful and seductive narrative around a soft landing and we’re just not seeing it in the data,” said Hollenhorst.

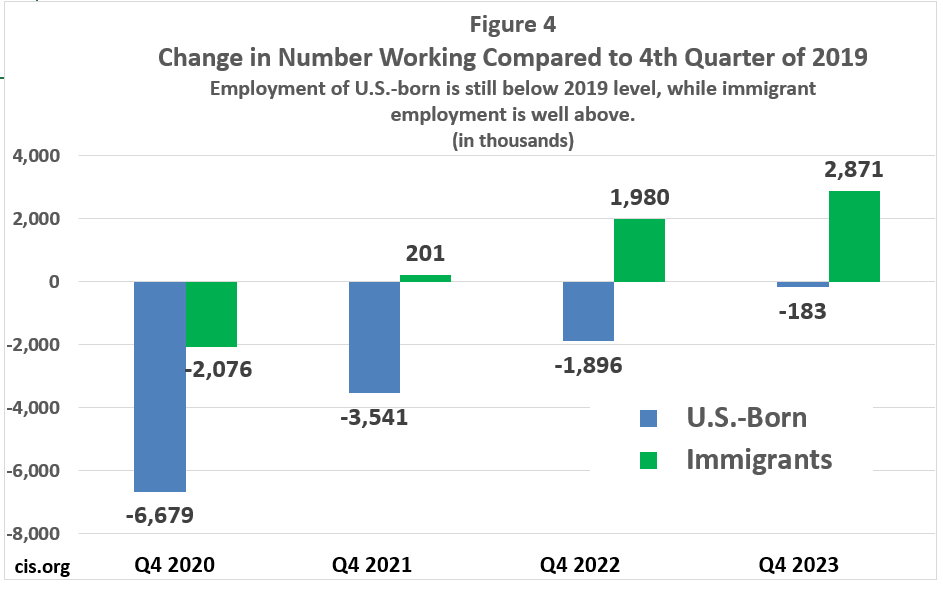

One key area of vulnerability is the labor market. Although January’s jobs report showed 353,000 ‘new’ jobs added to the economy, the number of hours worked actually declined, as did the number of full-time workers. Moreover, certain sectors, like the restaurant industry, did not see any job growth at all.

“That’s the key to the economy — what happens in the labor market,” Hollenhorst said. “If the unemployment rate stays low, people continue to spend, the economy holds up. But if that unemployment rate starts rising, which we think it will … that’s the sign that we’re going to have a more material decline in the US economy.”

Hollenhorts also pointed to rising credit card delinquencies as another indicator of impending recession.

“There may be some consumers out there with excess savings, but those consumers exposed to floating credit card debt with higher rates now, that have been pulling on those excess savings to continue to consume, continue to spend, now those delinquencies are picking up,” he said.

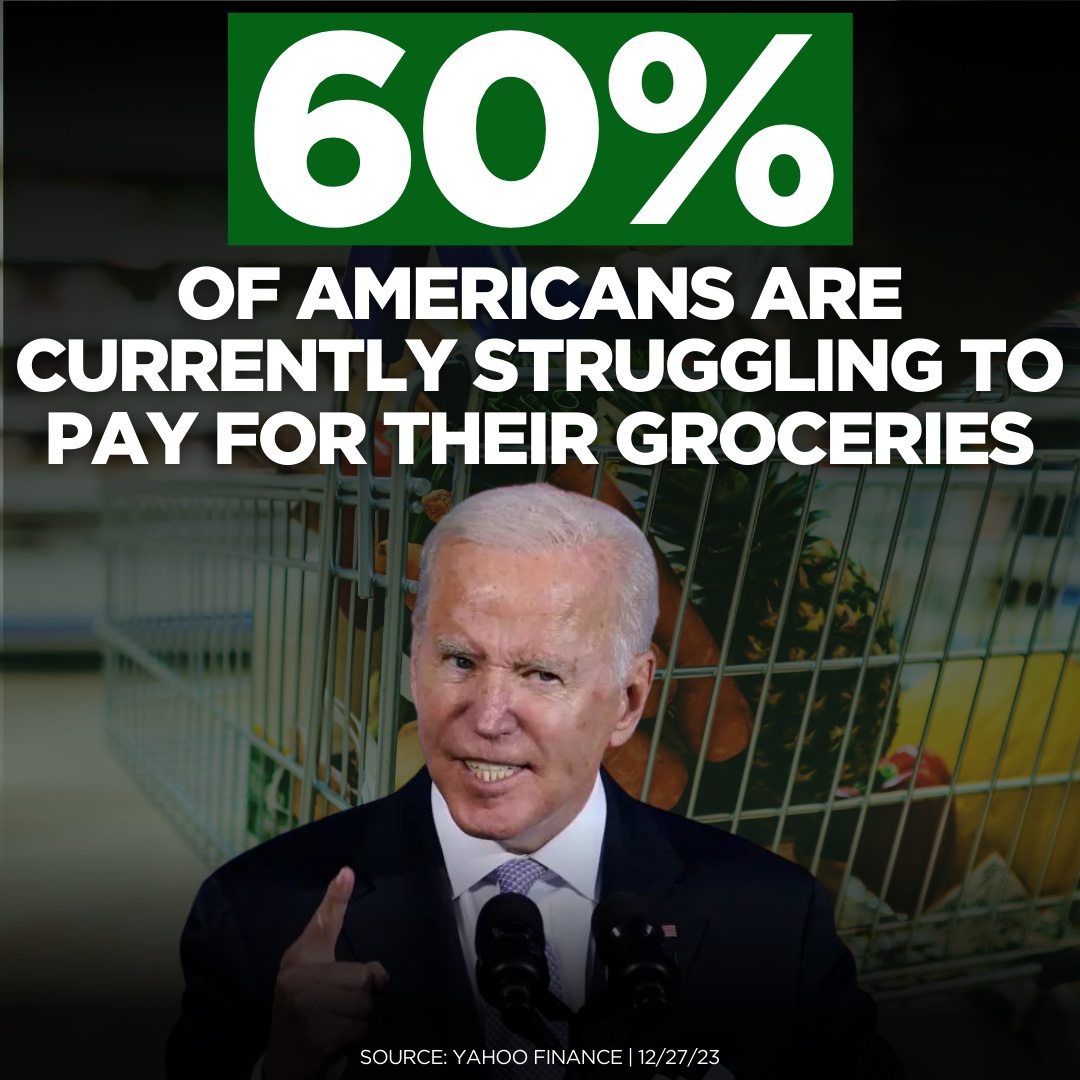

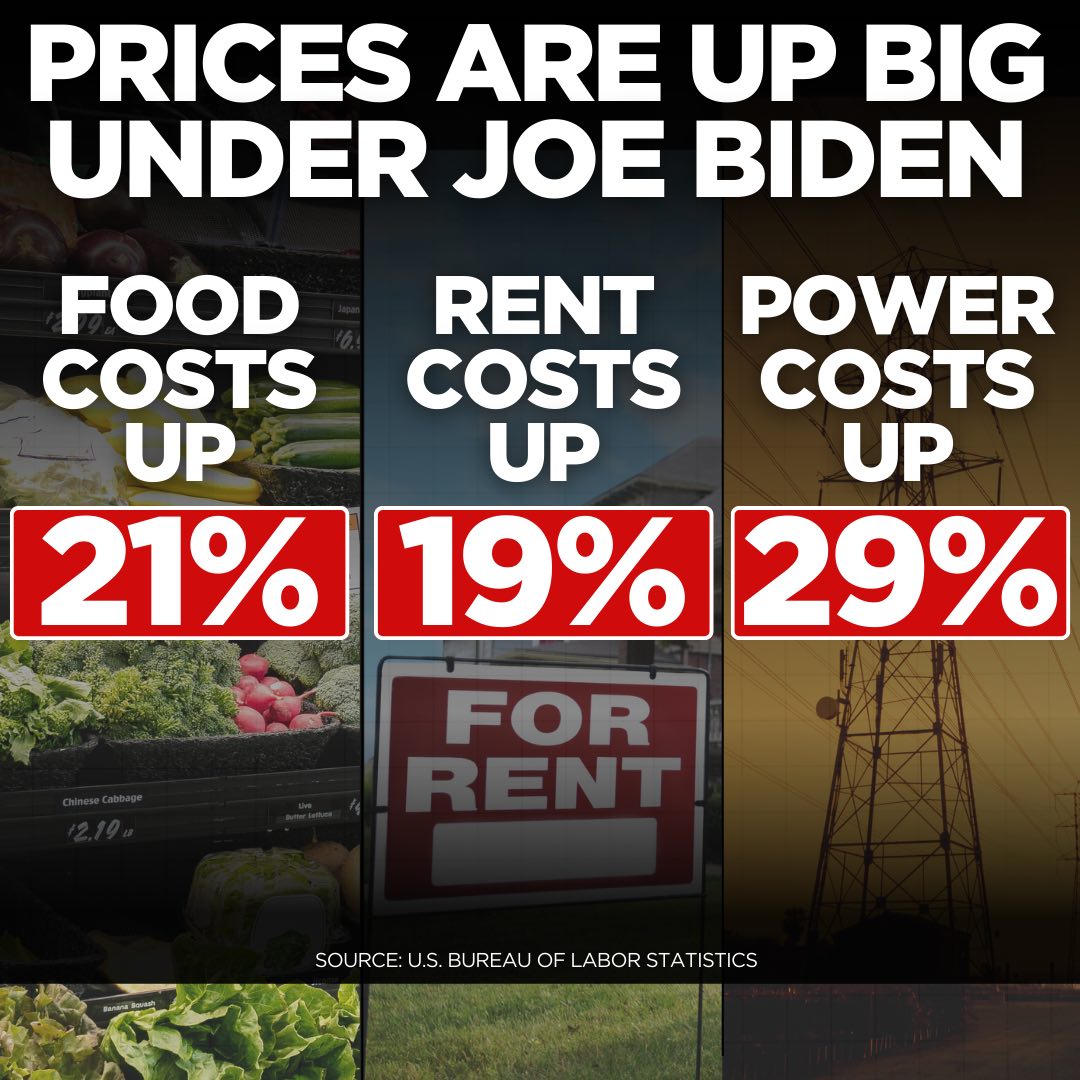

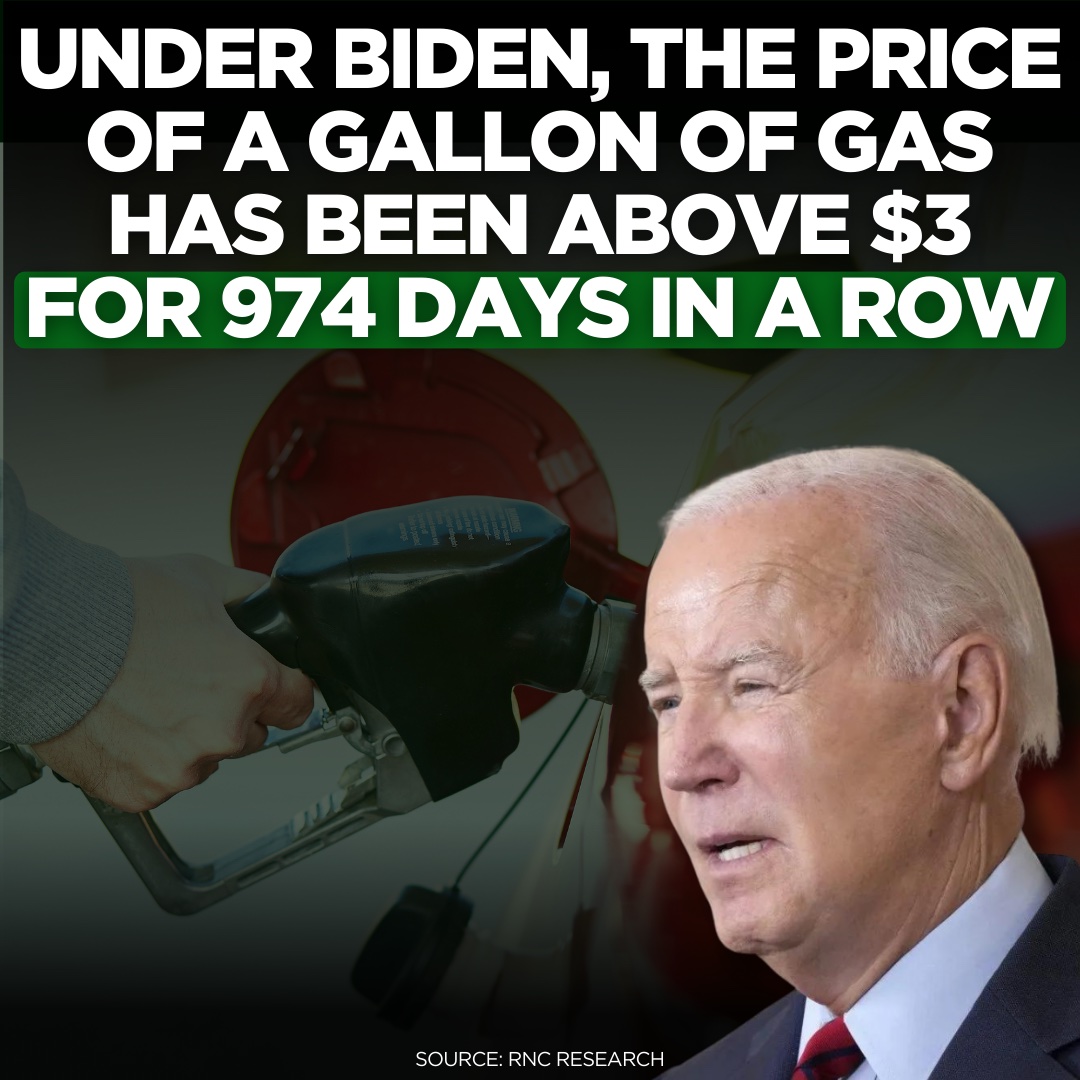

The state of the economy is set to be a key factor in the 2024 presidential election. Despite the Biden regime trying to take credit for GDP growth and rising jobs numbers, there is overwhelming evidence that Bidenomics has failed, and the majority of Americans have lost faith in Biden’s ability to manage the economy.

show less