❓WHAT HAPPENED: GE Appliances announced a $3 billion investment to shift production from China and Mexico to U.S. facilities, modernize plants, and expand domestic operations.

👤WHO WAS INVOLVED: GE Appliances, CEO Kevin Nolan, Kentucky Governor Andy Beshear, and GE employees and partners.

📍WHEN & WHERE: Announced Wednesday; involving facilities in Kentucky, Georgia, Alabama, Tennessee, and South Carolina.

💬KEY QUOTE: “Our long-term strategy is about manufacturing close to our customers.” – Kevin Nolan, CEO of GE Appliances.

🎯IMPACT: Over 1,000 jobs will be added, with production moving to U.S. plants and significant contributions to the U.S. economy.

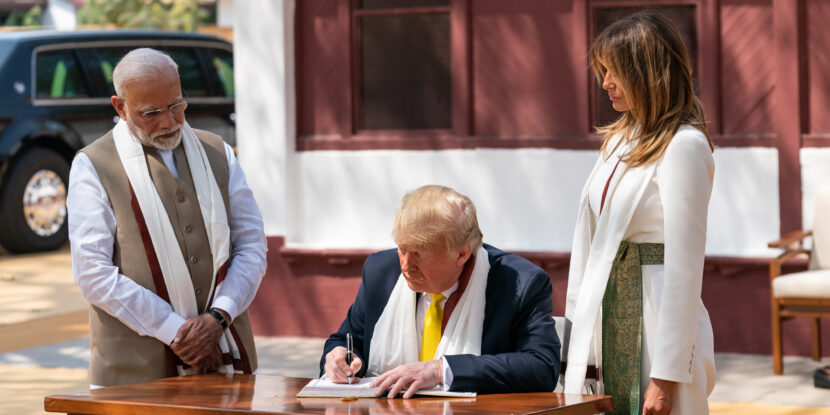

GE Appliances has announced a $3 billion investment to relocate production of refrigerators, gas ranges, and water heaters from China and Mexico to its U.S. facilities as part of a five-year plan. This initiative, which comes amid efforts by President Donald J. Trump to encourage the “reshoring” of manufacturing by imposing tariffs on foreign goods, will upgrade plants in Kentucky, Georgia, Alabama, Tennessee, and South Carolina, creating over 1,000 new jobs, and represents the second-largest investment in the company’s history.

CEO Kevin Nolan emphasized the focus on American manufacturing, stating, “Our long-term strategy is about manufacturing close to our customers.” The plan includes shifting gas range production from Mexico to Georgia and six refrigerator models from China to Alabama. Additionally, clothes washer production, announced in June, will move to Kentucky’s Appliance Park.

Kentucky Governor Andy Beshear (D) lauded the investment, saying, “GE Appliances has established Kentucky as America’s destination for advanced manufacturing and job creation,” highlighting the state’s skilled workforce and resources.

To support its American workforce expansion, GE Appliances is collaborating with universities, technical schools, and high schools. Company executive Bill Good noted, “America’s manufacturing renaissance will be built by people.”

Join Pulse+ to comment below, and receive exclusive e-mail analyses.