Italy’s Prime Minister Giorgia Meloni, elected on a national populist platform in late 2022, is preparing to splurge the equivalent of over a billion U.S. dollars on electric car subsidies in the name of reducing the Mediterranean country’s so-called carbon footprint.

The €930 million fund is expected to be announced in an upcoming decree, and will take effect from February. Italians will be offered a minimum of €6,000 (~$6,550) towards electric vehicles up to the value of €35,000 (~$38,200), rising to as much as €13,750 (~$15,200) if they also scrap an older vehicle.

Meloni’s focus on climate change will be a source of frustration for her voters given the fact the illegal immigration she promised to curb on the campaign trail is rising exponentially.

In addition to failing to bring illegal immigration under control, she is also greatly increasing legal immigration to Italy, authorizing the issuance of close to half a million visas to non-Europeans from 2023 to 2025.

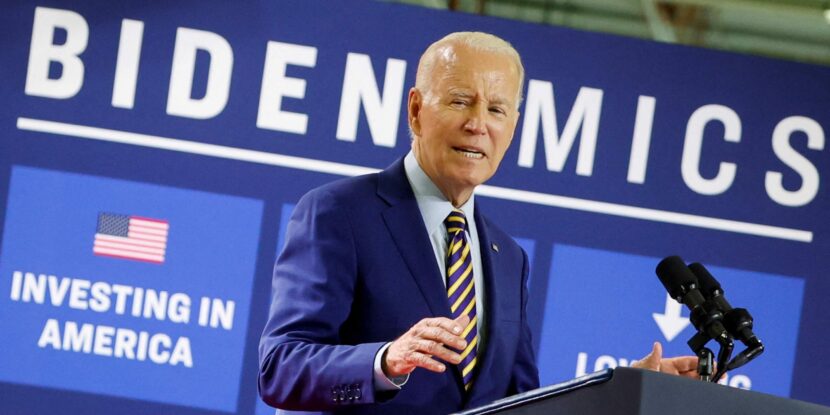

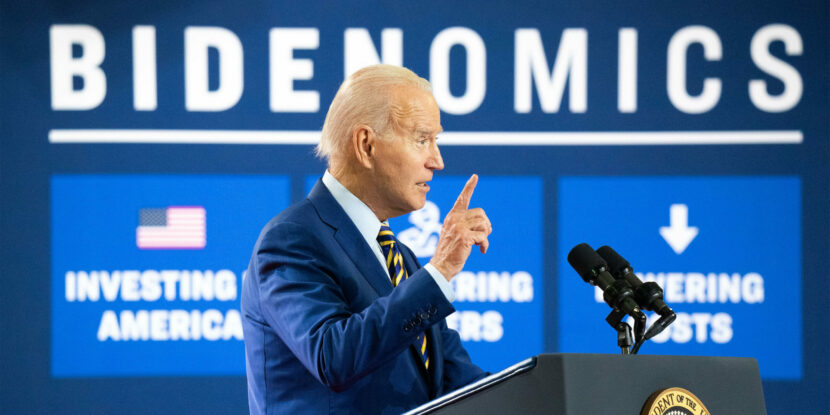

Once disparaged as Italy’s most right-wing leader since Benito Mussolini by the legacy media, the 46-year-old soothed Joe Biden and other globalist leaders by deemphasizing immigration control in favor of cheerleading Ukraine soon after entering office.

Martin Schulz, a German socialist and former President of the European Parliament, bragged that the European Union had disciplined her into becoming a “reliable partner” last year.

show less