Some 218,000 people filed for unemployment benefits in the week ending November 25th, n increase of 7,000 on the previous week.

The number of people collecting unemployment benefits rose by 86,000 in the week ending November 18th. All told, the number of people on unemployment benefits now stands at 1.93 million. This is the highest total recorded by the Labor Department in two years.

Claims have risen in nine of the last ten weeks, believed to reflect the fact it is becoming increasingly difficult to find work. Joe Biden enjoyed strong jobs growth early in his presidency as COVID-era restrictions lifted, but his economy has weakened significantly.

In September, 336,000 jobs appeared to have been created – but this was driven by an increase in part-time employment. Full-time jobs actually fell by 22,000. In October, new jobs came in 20,000 lower than expected. Government jobs increased by 51,000, but manufacturing jobs fell by 35,000.

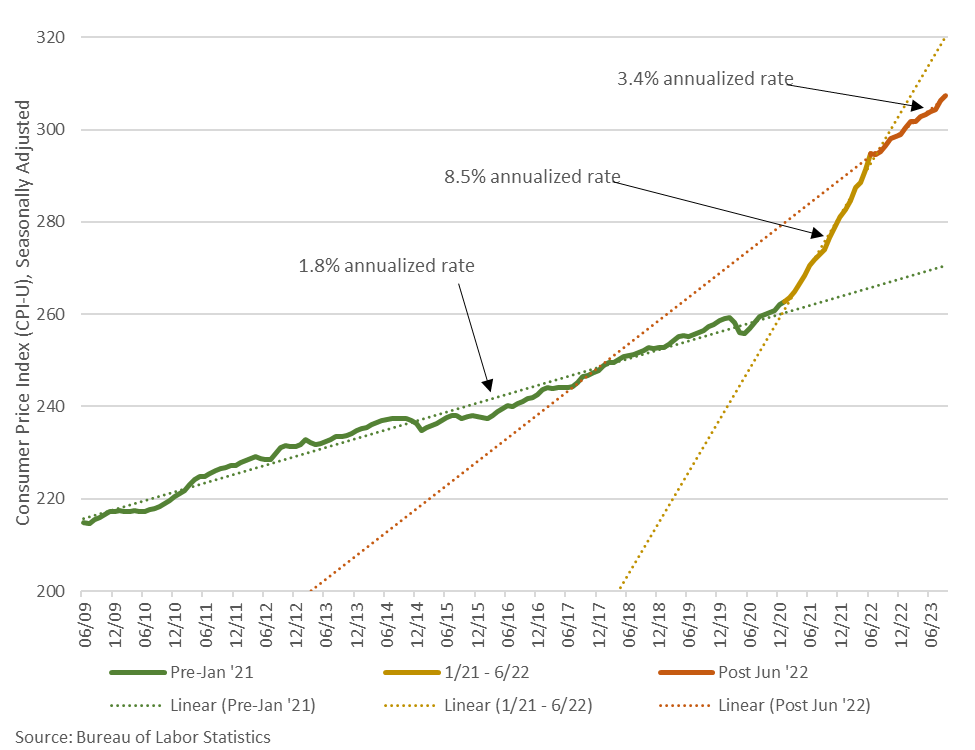

Inflation, which hit a four-decade high in 2022, has slowed, but this in largely due to the Federal Reserve hammering the country with 11 increases in its benchmark interest rate since March 2022. This has driven mortgage costs to their highest in decades, pricing many Americans out of housing.

show less