An interesting article in Quartz today celebrates the fact that Europe is experiencing a “goldilocks moment” for economic growth.

So which nations are leading the charge? Germany? France? The United Kingdom? Nope — all three of these nations are traveling side-by-side with the U.S. in the economic slow lane. To discover Europe’s all-stars of economic growth, one must travel further east.

While 3 percent economic growth in the U.S. is still seen as unattainable to pessimistic liberals, Poland, the Czech Republic, and Romania are growing at 4.4 percent, 4.7 percent, and 5.7 percent respectfully. As powerhouses of economic growth, these nations must be scratching their heads when tuning in to America’s debate over cutting the corporate tax rate.

One can imagine their confusion when reading remarks from economists like Dr. Joel Slemrod, who told the LA Times a corporate tax cut “isn’t by itself enough to make a dent in the growth rate” — despite these countries’ economies soaring in large part as a result of their low corporate tax rates.

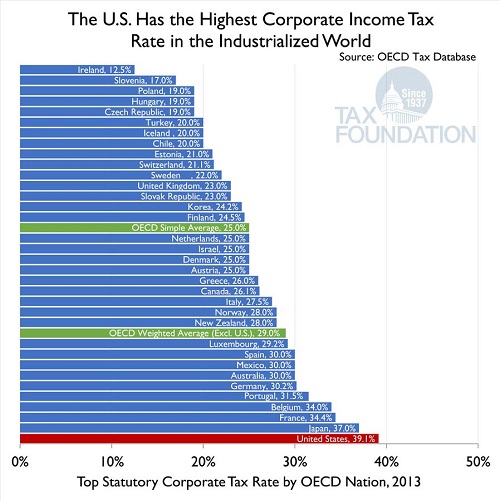

As the chart below shows, the Czech Republic and Poland have among the lowest corporate tax rates in the industrialized world. Romania, while not included, has an even lower corporate tax rate at 16 percent (and it’s experiencing the fastest economic growth of the three!):

While these three economies are experiencing a “goldilocks” moment for economic growth, America’s economic porridge is still served cold.

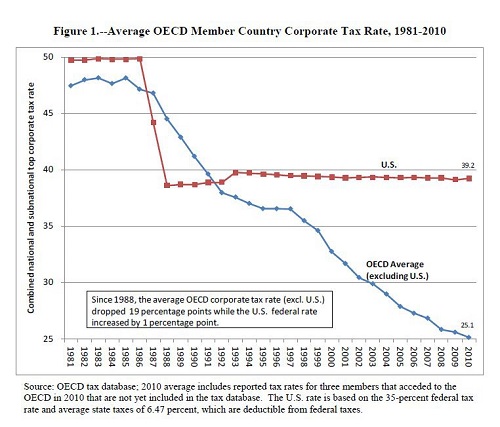

This is in no doubt in part due to our high marginal corporate tax rate, which remains at the top of the industrial world. As the chart below shows, since 1988, the average U.S. corporate tax rate (federal and state) increased by 1 percent, while the average corporate rate for the rest of the developed world decreased by 19 percent:

Industrialized nations have steadily lowered their corporate tax rates over the past couple decades while the U.S. has remained on economic auto-pilot.

Some would point out that American businesses are able to lower their burden well below the marginal rate (well, more so the larger ones), but remember that doing so requires hiring accountants — and possibly lobbyists — and an enormous amount of effort is wasted for the purpose of lowering their tax burden. That is not the most productive way for our businesses to spend their time or money.

Eastern Europe’s growth juggernauts are showing the U.S. the way to unleash prosperity. Their booming economies are kryptonite to those who doubt the importance of achieving historic tax reform.