As the political fight over tax cuts ramps up, a new progressive coalition has formed in order “to oppose any effort to cut taxes for the wealthy.” Unfortunately for those enlisting in this new front for the “resistance” movement, the economic arguments put forth by “Not One Penny” make no cents.

“Not One Penny” is a partnership between liberal groups including MoveOn.org, Tax March, and the Center for American Progress. While the coalition’s mission to ensure “Not One Penny” in tax cuts is given to wealthy Americans seems straight forward — is it?

An exhaustive search of their website failed to yield a specific income level or definition for when an individual or corporation falls under the vilified “rich” category. Is the threshold $250,000 in income, as it was when President Obama campaigned in 2008? While I concede a person making $250,000 a year is certainly living comfortably, after being subject to a 33 percent federal income tax, payroll taxes, state income taxes, and property taxes, is this person truly “rich” and undeserving of a tax break? What if the person is also paying to put a kid through college? Perhaps it doesn’t matter, as PolitiFact rates President Obama’s guarantee that “no family making less than $250,000 a year will see any form of tax increase” as a promise broken.

But putting aside Not One Penny’s intentionally vague criteria for who is among the dreaded “rich” category for whom tax cuts will “not help our economy grow,” why should we cut taxes for the rich?

To answer this question calls to mind a quote long attributed to famed bank robber Willie Sutton. As legend goes, when Willie Sutton was asked by a reporter “why do you rob banks,” he answered “because that’s where the money is.”

Why will cutting taxes for the wealthy spur economic growth? Because that’s where the money is.

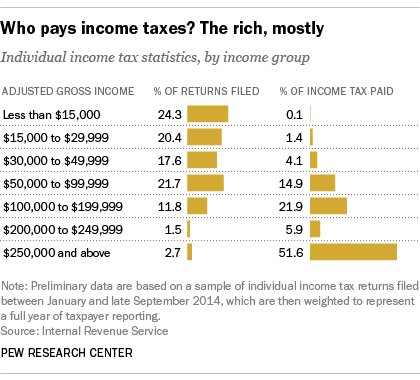

As the above chart from Pew Research Center shows, those who make over $250,000 a year (a mere 2.7 percent of total tax returns) pay more than half of all income taxes. On the other side, those making less than $100,000 a year (84 percent of total tax returns) pay roughly 20 percent. While I’m all for tax relief across all brackets, let’s be real — how do you get skyrocketing economic growth through tax cuts without including those who pay the majority of taxes?

Yet progressives, as seen on Not One Penny’s website, maintain that tax cuts for wealthy individuals will “not help our economy grow.” Liberals act as if tax cuts for the rich will result in Jeff Bezos and Mark Zuckerberg hoarding dollars under their mattress for all eternity — which is the only way their theory would make sense. Even if Bezos and Zuckerberg chose not to reinvest any of their tax cut savings into expanding their businesses, improving productivity, or boosting employee wages, where does that money wind up? Not under a mattress, but in a bank — where it is immediately lent out to support business startups, facilitate mortgages, and create other loans. The money is put to work immediately and spent by much wiser stewards of capital than if it were in the coffers of Washington, D.C.

Of course, liberals would caricature the above as “trickle down economics”, but this is merely one side of the coin for why tax cuts are good for economic growth. Even if Bezos and Zuckerberg did take their additional income from tax reform and shove it under a mattress, their tax cuts would still be beneficial to our economy — because it would incentivize them to work harder. After all, they would get to keep more of their money.

Why wouldn’t we want to incentivize people like Steve Jobs, Jeff Bezos, Mark Zuckerberg, and Travis Kalanick to work more hours, or take on additional projects, when their production tremendously enriches our lives? As Steve Forbes recently pointed out, “nobody cares if Bill Gates gets richer.” Our economic pie is not finite; our lives are solely enriched by the tremendous ability of others to create.

Lastly, as mentioned above, Not One Penny also opposes all tax cuts to wealthy corporations. Putting aside that, once again, if we share a common end goal of igniting booming economic growth, cutting taxes on America’s most successful businesses is an absolute no-brainer. Does anyone really believe that the middle class wouldn’t benefit tremendously from a cut to the corporate tax rate?

Corporations don’t pay taxes, people do. The burden of America’s corporate tax rate does not fall on the “fat cat CEO,” but rather on middle class workers through lower wages, middle class and upper middle class shareholders through shortened dividends, and middle class consumers through higher prices. For more on this, a supremely brilliant column by Megan McArdle in The Atlantic makes a compelling case for why progressives should hate America’s corporate income tax. The middle class would benefit enormously from a steep cut to America’s 39 percent marginal corporate tax rate.

So will Not One Penny’s refusal to cut taxes on “the rich” create the soaring economic growth Americans desperately seek? Not for my money. Let’s give all Americans a tax cut, even the vilified rich people.

Photo credit: 401(K) 2012 via Flickr, CC BY-SA 2.0