❓WHAT HAPPENED: Texas Republican congressional candidate Steve Toth, who defeated anti-Trump Representative Dan Crenshaw (R-TX) in last week’s Republican primary, announced he is backing Texas Attorney General Ken Paxton over incumbent Senator John Cornyn in the Republican Senate primary run-off election.

👤WHO WAS INVOLVED: Steve Toth, Ken Paxton, and John Cornyn.

📍WHEN & WHERE: The endorsement was made on Monday, March 9, 2026.

💬KEY QUOTE: “On a personal level, I know Ken as a selfless servant who has always put Texas before his own personal interests. That is what we desperately need from the people we send to D.C., and it’s why I am endorsing him in his race to be our next United States Senator.” — Steve Toth

🎯IMPACT: Paxton, a staunch supporter of President Donald J. Trump, is facing immense pressure from establishment and anti-Trump Republicans to drop out of the race, as they view Cornyn, who has frequently been at odds with Trump, as more reliable.

Texas Republican congressional candidate Steve Toth, who defeated anti-Trump Representative Dan Crenshaw (R-TX) in last week’s Republican primary, announced he is backing Texas Attorney General Ken Paxton over incumbent Senator John Cornyn in the Republican Senate primary run-off election. “During my time in the Texas Legislature, I have come to know Ken Paxton on both a professional and personal level. As our Attorney General, Ken has been a staunch defender of conservative values and constitutional rights,” Toth said in an interview published Monday.

“Ken often served as the last line of defense for Texans during the Biden Administration years, securing major wins for border security, blocking COVID-19 vaccine mandates, and protecting our children. Ken Paxton is battle-tested,” Toth continued, adding: “On a personal level, I know Ken as a selfless servant who has always put Texas before his own personal interests. That is what we desperately need from the people we send to D.C., and it’s why I am endorsing him in his race to be our next United States Senator.”

During the March 3 primary, Toth defeated incumbent Congressman Dan Crenshaw by over 15 points, and, with nearly 100 percent of the vote reporting, captured 55 percent of the electorate. Importantly, Toth’s victory is well past the 50 percent needed to avoid a runoff election.

Meanwhile, Paxton and Cornyn are slated to face off in a runoff on May 26 as neither candidate hit the 50 percent threshold. Paxton, a staunch supporter of President Donald J. Trump, is facing immense pressure from establishment and anti-Trump Republicans to drop out of the race, as they view Cornyn, who has frequently been at odds with Trump, as more favorable.

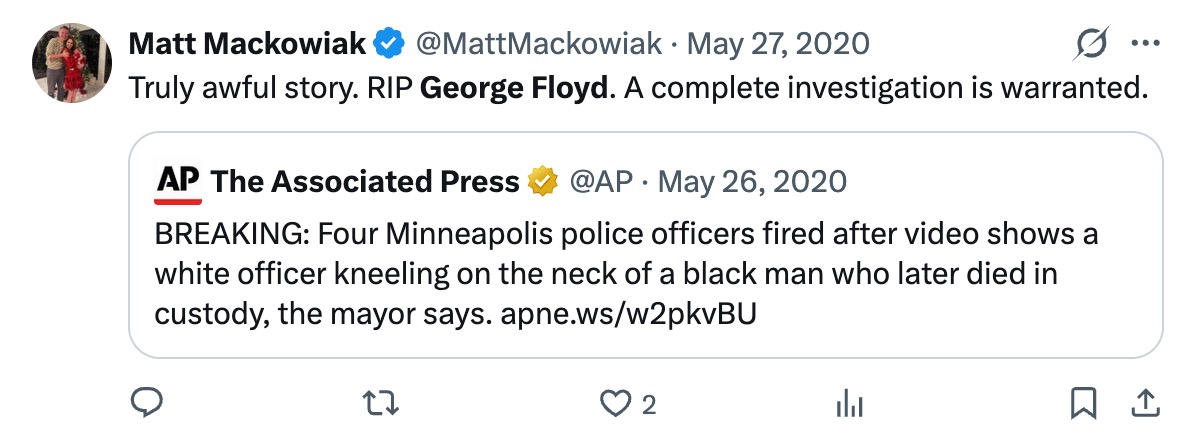

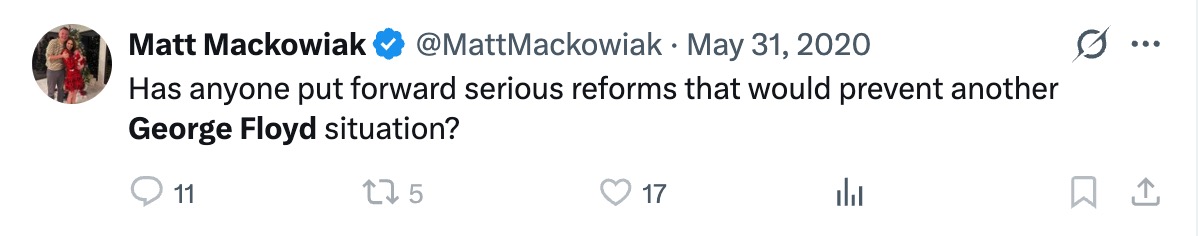

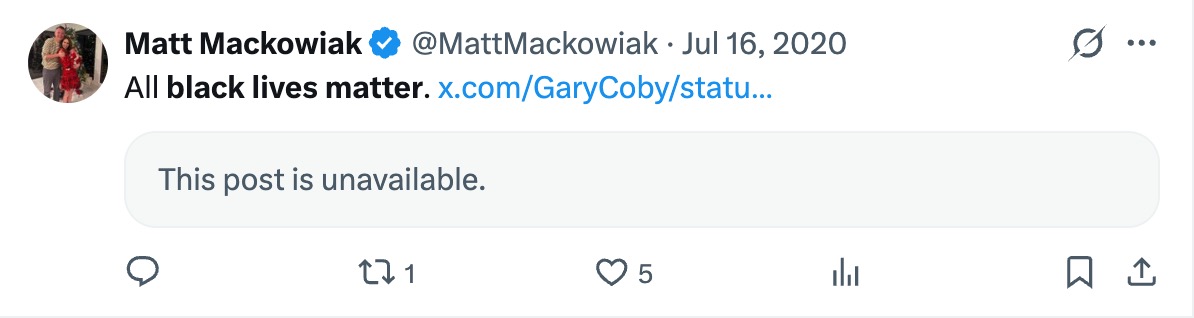

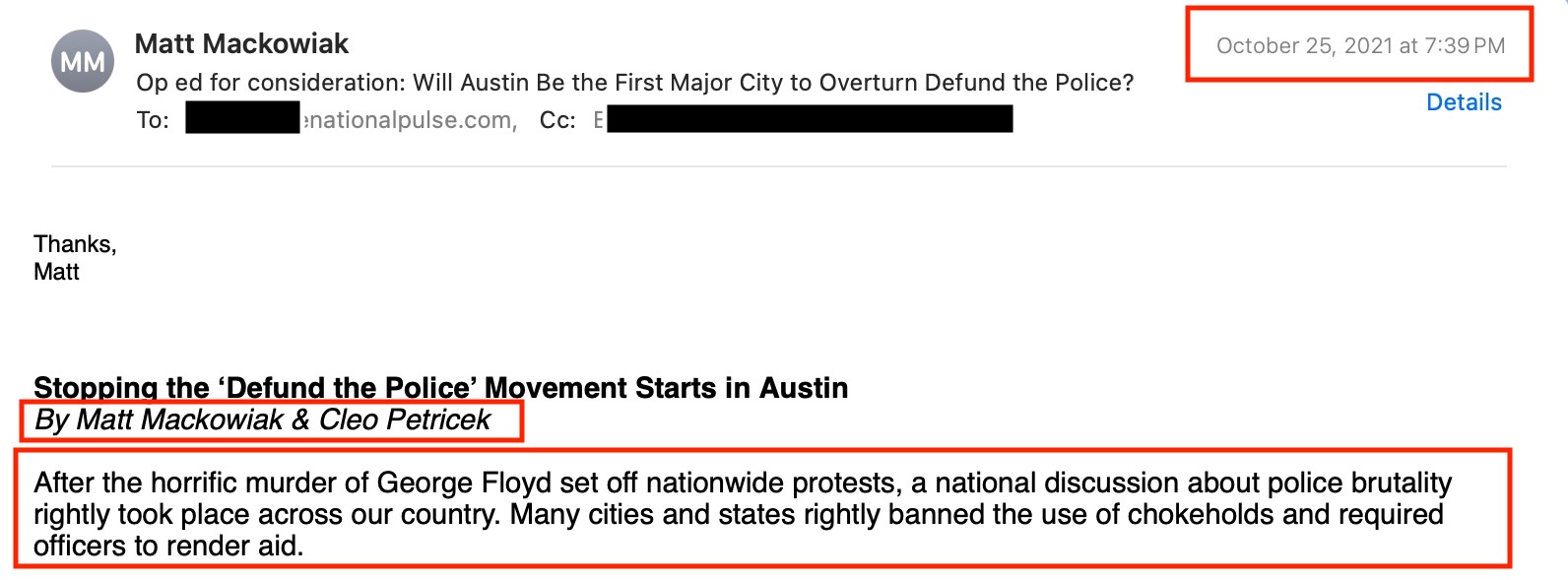

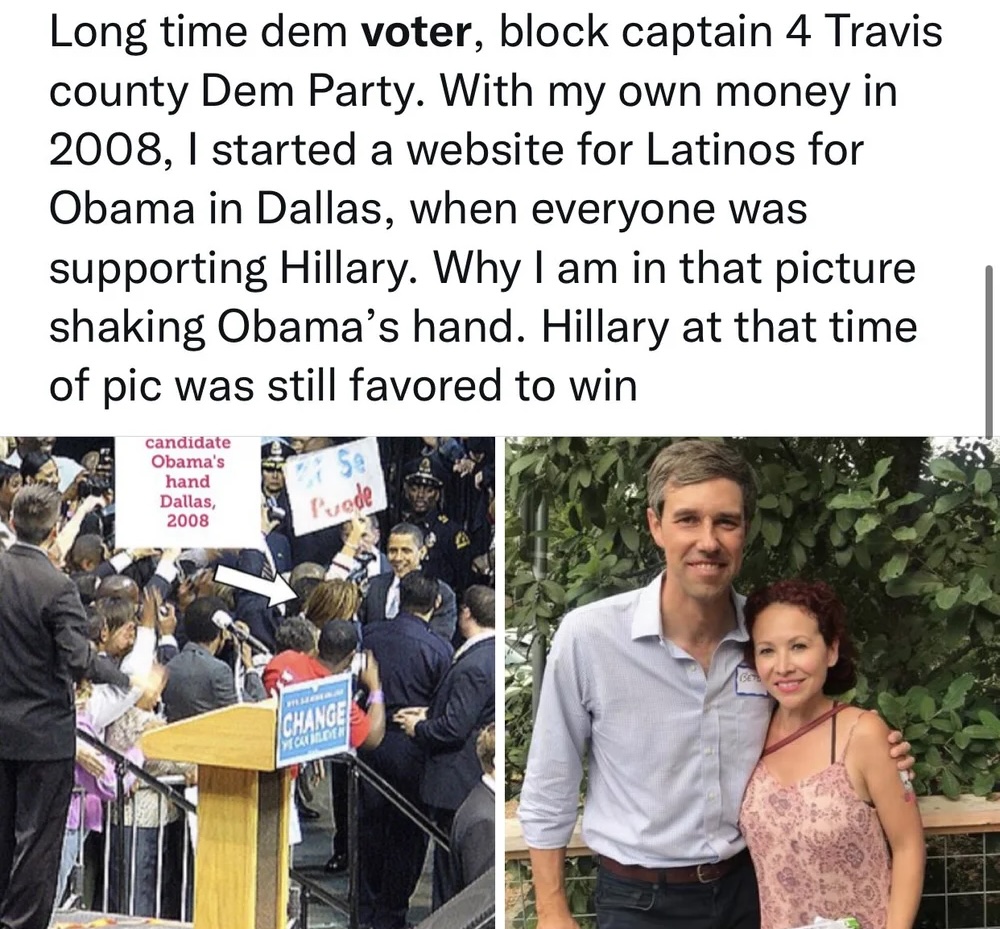

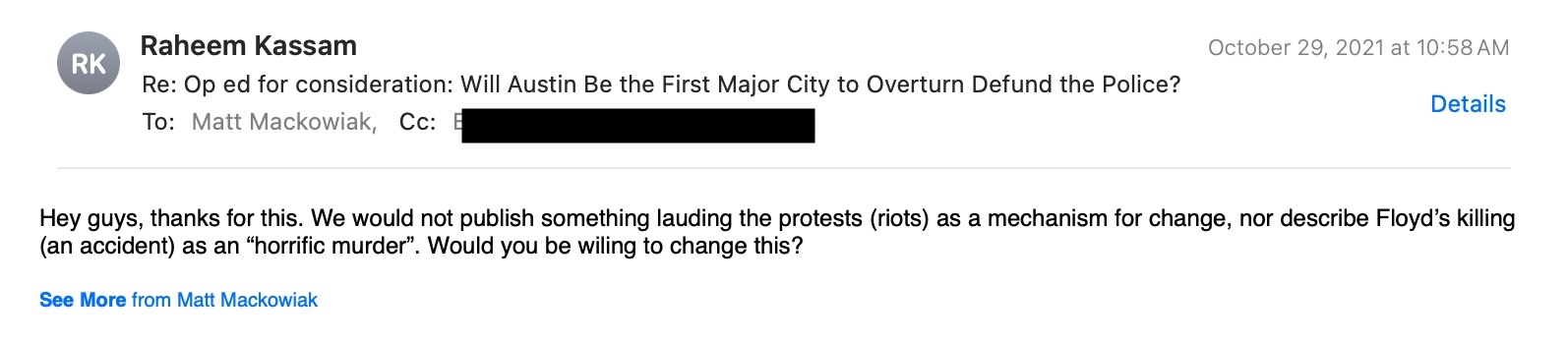

The National Pulse has reported extensively on the dubious actions and statements of Cornyn’s staff. Over the past weekend, for instance, The National Pulse Editor-in-Chief Raheem Kassam revealed that in late May 2020, at the beginning of the “mostly peaceful” Black Lives Matter “summer of love” riots, Cornyn’s campaign communications director, Matt Mackowiak, was posting pro-George Floyd messages on his social media accounts. Mackowiak would even pitch a pro-Floyd op-ed to The National Pulse over a year later, in October 2021.

Join Pulse+ to comment below, and receive exclusive e-mail analyses.