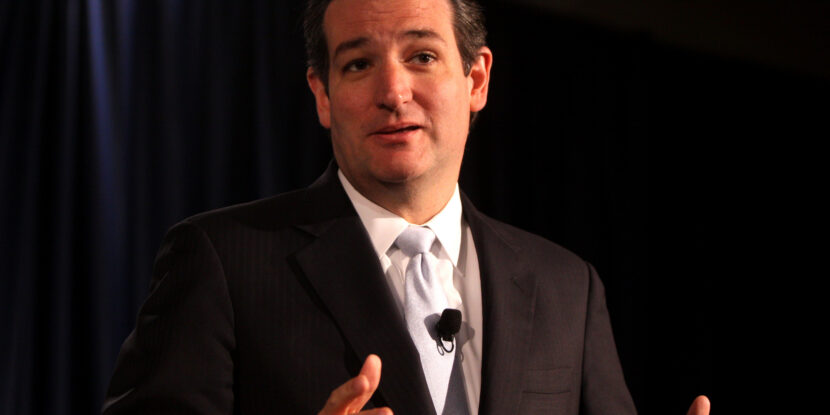

In Tuesday night’s Fox Business News Presidential Debate, Ted Cruz provided the most coherently compelling recipe for economic growth. It stood out even from several other fine packages (Rubio, Bush, Paul, and Kasich, with the material exception of his pledge to bail out the big banks). It left in the dust Mr. Trump, Dr. Carson, and Ms. Fiorina’s far more vague, and often dubious, propositions.

Cruz’s presentation was especially notable for being succinct, proactive, and a profile in courage. What courage? Cruz has experienced a measure of vilification by the Left for his embrace of the gold standard.

What, in particular, was exceptional in Sen. Cruz’s presentation on his economic plans? Early on, Cruz provided a clear, thoughtful, unified worldview. This was a quality also showed by Reagan, and Cruz’s worldview is very much in accord with Reagan’s:

BARTIROMO: Senator Cruz, the International Monetary Fund recently cut its expectations for economic growth. Many economists expect a recession to hit the U.S. within the next year due to the weakening of manufacturing. The next president will have to deal with it. You say tax reform is a powerful lever to spur economic expansion. You’re calling for a 10 percent income tax and a 16 percent business tax. What other elements do you need in this plan to actually create jobs?

CRUZ: Well, Maria, it’s great to be with you. It’s great to be here in Milwaukee. You know, the question you asked really I think is the most important question any of us can have — face, which is, how do we get the economy growing? How do we bring back economic growth?

Because economic growth, it’s foundational to every other challenge we have. As you rightly noted, from 2008 to today, our economy has grown 1.2 percent a year on average. The Obama economy is a disaster, and the IMF is telling us this is a new normal. It doesn’t have to be.

If you look at the history of America, there are three levers that government has had to facilitate economic growth. The first is tax reform. And as you noted, I have rolled out a bold and simple flat tax: 10 percent for every American that would produce booming growth and 4.9 million new jobs within a decade.

The second element is regulatory reform, pulling back the armies of regulators that have descended like locusts on small businesses.

And the third element is sound money. Every time we’ve pursued all three of those — whether in the 1920s with Calvin Coolidge or the 1960s with JFK or the 1980s with Ronald Reagan — the result has been incredible economic growth. We have done it before, and with leadership, we can do it again.

Note how directly Sen. Cruz answered Bartiromo’s question, “What other elements do you need in this plan to actually create jobs?” All the other major candidates have proposed significant tax reforms. All embrace regulatory reform. Tax and regulatory reform are necessary but not sufficient. Cruz was unique in placing “sound money” among the strategic factors necessary to produce “incredible economic growth.”

Cruz, later, took the initiative on defining exactly what he means by “sound money.” Using a question by Neil Cavuto, on hypothetical future banking crises, as a springboard, Cruz pivoted to the far more fundamental issue: What monetary policy is required to avert such crises in the first place?

CRUZ: So let me be clear. I would not bail them out, but instead of adjusting monetary policy according to whims and getting it wrong over and over again and causing booms and busts, what the Fed should be doing is, number one, keeping our money tied to a stable level of gold, and, number two, serving as a lender of last resort.

That’s what central banks do. So if you have a run on the bank, the Fed can serve as a lender of last resort, but it’s not a bailout. It is a loan at higher interest rates. That’s how central banks have worked.

And I’ll point out — look, we had a gold standard under Bretton Woods, we had it for about 170 years of our nation’s history, and enjoyed booming economic growth and lower inflation than we have had with the Fed now.

We need to get back to sound money, which helps, in particular, working men and women.

Cruz knowledgeably and courageously raised, without prompting, the quality the gold standard in setting and maintaining high integrity money as a platform for “booming economic growth and lower inflation.” Cruz grounded his answers, in both the first and second exchanges on the topic, not in chalkboard equations but in what the classical gold standard’s greatest living advocate, Lewis E. Lehrman, calls “the laboratory of history.”

Cruz has his priorities — “incredible economic growth” — exactly right. He earns credibility for presenting the full suite of policies needed to get there. He shows authenticity in laying out with impeccable specificity his plan (on taxes, spending cuts, and monetary policy).

Cruz also demonstrated leadership and courage. The panel did not ask Cruz about the gold standard (which he first had raised in the CNBC debate). Cruz took the lead on this matter and laid it out. And as for courage, Cruz’s proposal of gold has received the expected amounts of ill-informed criticism from the Left. It also earned some of the Left’s signature tactic: ridicule.

Left-wing ridicule of Cruz’s advocacy for gold has been evidenced several times. It surely will emerge again and again. Most recently it was in evidence in an interview in Salon.com. This interview evidences a complete factual misrepresentation of the gold standard as deflationary, recessionary, and a recipe for austerity. Amidst this display of ignorance, Salonista Scott Timberg coaxed Progressive era historian Eric Rauchway, of the University of California, Davis, into the following exchange:

[Gold] does seem to have a symbolic or psychological meaning even to people who don’t fully understand it. What’s the irrational appeal of the gold standard?

[…]

This is where Freud would come in. This reluctance to part with something that is precious to you, this insistence on discipline. He identified a personality that was what he called parsimonious to the point of avarice, and you and I have probably heard the term “anal retentive” … He went into the folklore of Europe and the relationship between gold and feces, which is apparently quite strong. He identified that personality type as being typical of enthusiasm for the gold standard.

Prof. Rauchway hereby, in a stylistically erudite way, thus engages in the academic equivalent of a monkey flinging its poo. As I wrote last year in Forbes.com about the same sly employment of poo-flinging by Prof. Paul Krugman:

Prof. Krugman, echoing a clever critique by Keynes, himself has invoked Freud as key to understanding proponents of the gold standard. Freud, speculating on subconscious associations between excrement and money, referenced the Babylonian doctrine that “gold is the feces of Hell.” Thus, implies Prof. Krugman, proponents of a gold standard are stuck in an infantile “anal-retentiveness.”

Keynes, perhaps not getting it quite right, alludes to Freud in Auri Sacra Fames (September 1930):

Dr. Freud relates that there are peculiar reasons deep in our subconsciousness why gold in particular should satisfy strong instincts and serve as a symbol.

It presumably is this to which Prof. Krugman obscurely alludes in a blog entitled The She-Devil of Constitution Avenue:

I’ve been saying for a long time that we aren’t having a rational argument over economic policy, that the inflationista position is driven by politics and psychology rather than anything the other side would recognize as analysis. But this really proves it beyond a shadow of a doubt; if you really want to understand what’s going on here, the Austrian you need to read isn’t Friedrich Hayek or Ludwig von Mises, it’s Sigmund Freud.”

[…]

Eruditely ridiculing gold proponents as, well, full of s*** is clever. It likely will tickle those readers who find monkeys flinging poo at each other hilarious. Ridicule is much easier, and cheaper, than grappling with scholarly analyses such as that from the Bank of England which provided, in 2011, Financial Stability Paper No. 13, a genuinely interesting critique of the real world performance of fiduciary currency.

That paper is a rigorous analysis of the empirical performance of the fiduciary Federal Reserve Note standard in comparison to the Bretton Woods gold-exchange standard and the classical gold standard. It does not, at least not explicitly, advocate for either predecessor standard. It simply assesses that the Federal Reserve Note standard in practice has proved substantially worse than its predecessors (and calls for the exploration of a rule-based system). A thoughtful response by Prof. Krugman to this paper would be far more interesting, and edifying, than sly scatological insults.

Cruz got his priorities — “incredible economic growth” — exactly right. Cruz focused special attention on benefits to working people. Cruz uniquely presented a coherent, clear, and distinct program — tax, regulatory, and monetary reform —as essential to equitable prosperity. Cruz has provided impeccable specificity for his prosperity package. Cruz confidently relies upon history. Cruz is unintimidated by left-wing ridicule for his featuring of the gold standard.

For these reasons, Ted Cruz firmly has established himself as the thought leader among Republican presidential contenders in the two issues — jobs and the economy — which all polling consistently shows to be the most important to voters, Republican, Democratic, and independent. Cruz, in short, shows himself to be eminently presidential.

Ralph Benko, internationally published weekly columnist, co-author of The 21st Century Gold Standard, lead co-editor of the Gerald Malsbary translation from Latin to English of Copernicus’s Essay on Money, is American Principles Project’s Senior Advisor, Economics.