PULSE POINTS:

❓What Happened: London has dropped out of the world’s top five richest cities due to an exodus of millionaires.

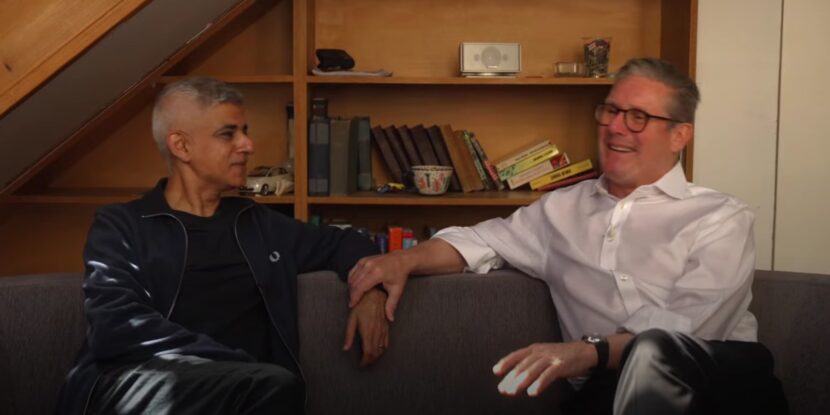

👥 Who’s Involved: New World Wealth and Henley & Partners, Prime Minister Keir Starmer, Chancellor Rachel Reeves, Mayor Sadiq Khan.

📍 Where & When: London, England, over the last decade.

💬 Key Quote: Andrew Amoils of New World Wealth stated, “Capital gains tax and estate duty rates [IHT] in the UK are among the highest in the world, which deters wealthy business owners and retirees from living there.”

⚠️ Impact: London lost 11,300 millionaires last year, including two billionaires. The multicultural city’s financial standing has diminished, and it remains the fourth most expensive globally for living costs.

IN FULL:

A recent report reveals that London, England, is no longer among the top five wealthiest cities globally following a significant outflow of millionaires. The study by New World Wealth for advisory firm Henley & Partners indicates that London, led by Mayor Sir Sadiq Khan of the Labour Party, lost 11,300 millionaires and two billionaires over the past year alone.

The report, which defines wealth as liquid investable assets such as stocks and bonds, shows London’s current count at roughly 215,700 millionaires. Hikes in local and national taxes and the declining value of the British pound have been cited as key reasons for the city’s reduced allure to the affluent.

A notable change in British tax policy under Prime Minister Sir Keir Starmer’s far-left Labour government, particularly the abolition of the non-domiciled tax status, is exacerbating the exodus. Wealthy individuals who have resided in the United Kingdom for over four years are now subject to British tax on worldwide income and potentially a 40 percent inheritance tax. As such, many are relocating to more tax-friendly locales, including Portugal, Greece, and Italy, where they can minimize or avoid equivalent taxes.

Andrew Amoils from New World Wealth stated, “Capital gains tax and estate duty rates [IHT] in the UK are among the highest in the world, which deters wealthy business owners and retirees from living there.” He noted that the retreat of multi-millionaires, individuals whose financial ventures shaped many companies in London’s FTSE 100, presents a wider economic risk.

London, a hyper-diverse city where only around a third of the population are White British and around 40 percent of the population are foreign-born, is also suffering reputational damage as a result of endemic crime and anti-social behavior.