❓WHAT HAPPENED: President Donald J. Trump announced new measures aimed at addressing housing affordability for Americans, including restrictions on the purchase of homes by large investment firms and hedge funds.

👤WHO WAS INVOLVED: President Trump, large institutional investors, single-family home buyers, Fannie Mae and Freddie Mac, and attendees of the World Economic Forum (WEF) summit in Davos, Switzerland.

📍WHEN & WHERE: The announcement was made on January 21, 2026, at the WEF meeting in Davos, Switzerland.

💬KEY QUOTE: “Homes are built for people, not for corporations, and America will not become a nation of renters.” — President Trump

🎯IMPACT: While the Executive Order does not ban outright large institutional investors’ ability to acquire single-family homes, President Trump’s directive places strict limits on conventional mortgage guarantees sought by investment firms when purchasing single-family residences.

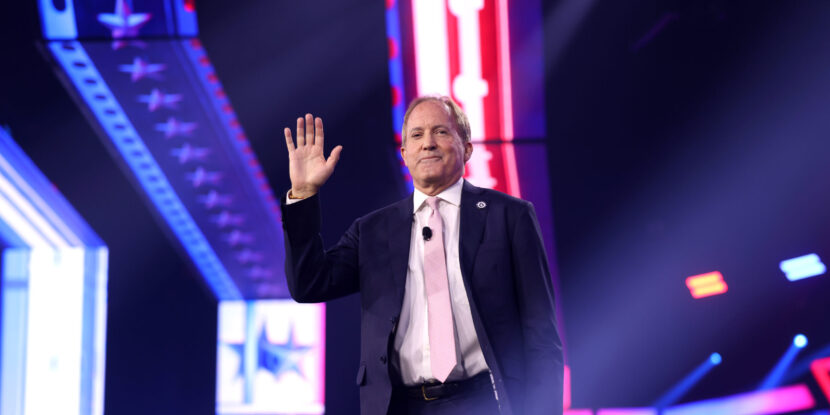

President Donald J. Trump, speaking at the World Economic Forum (WEF) summit in Davos, Switzerland, on Wednesday, announced new measures aimed at addressing housing affordability for Americans, including restrictions on the purchase of homes by large investment firms and hedge funds. Late Tuesday, President Trump signed an Executive Order that restricts federal agencies from facilitating the financing or insuring of single-family homes by “large institutional investors.”

“Homes are built for people, not for corporations, and America will not become a nation of renters,” President Trump told WEF attendees. “That’s why I have signed an executive order banning large institutional investors from buying single-family homes. It’s just not fair to the public. They’re not able to buy a house.”

While the housing policy Executive Order does not ban large institutional investors from acquiring single-family homes outright, the directive places strict limits on conventional mortgage guarantees sought by investment firms when purchasing single-family residences. Notably, the measure does not impact cash buyers or investment firms that use financing not backed by Fannie Mae and Freddie Mac.

The National Pulse reported in June of 2024 that under the former Biden government, mortgage costs began to rise once again—mostly due to inflation—and caused a spike in foreclosures. This resulted in a flood of residential property sales that drew significant interest from alternative asset management firms, such as Blackstone, which purchased these properties to generate a steady stream of rental revenue for their investors.

Join Pulse+ to comment below, and receive exclusive e-mail analyses.