PULSE POINTS

❓WHAT HAPPENED: The Department of Homeland Security’s Operation Metro Surge and wider immigration enforcement effort in Minnesota has swept up many criminal illegal aliens, including killers and child molesters.

👤WHO WAS INVOLVED: The Department of Homeland Security (DHS), DHS Assistant Secretary Tricia McLaughlin, criminal illegals, Minnesota Governor Tim Walz (D), Minneapolis Mayor Jacob Frey (D), and anti-ICE activists.

Your free, daily feed from The National Pulse.

Thank You!

You are now subscribed to our newsletter.

📍WHEN & WHERE: January 2026, Minnesota.

💬KEY QUOTE: “Many of these public safety threats were released from Minnesota jails. We are calling on Governor Walz and Mayor Frey to honor the more than 1,360 detainers of the illegal aliens in Minnesota jails.” – Tricia McLaughlin

🎯IMPACT: The criminal histories of many migrants being arrested in Minnesota prove that they represent a clear and present danger to the American public, despite state Democrats’ claims that ICE is not needed in the state.

Many of the illegal immigrants detained in Minnesota, in the face of fierce resistance from Democrats and anti-ICE activists, are criminals with convictions for offenses including homicide, child rape, and drug trafficking. The National Pulse has found many examples of dangerous offenders who are in the U.S. despite having been issued final deportation orders as long ago as the 1990s:

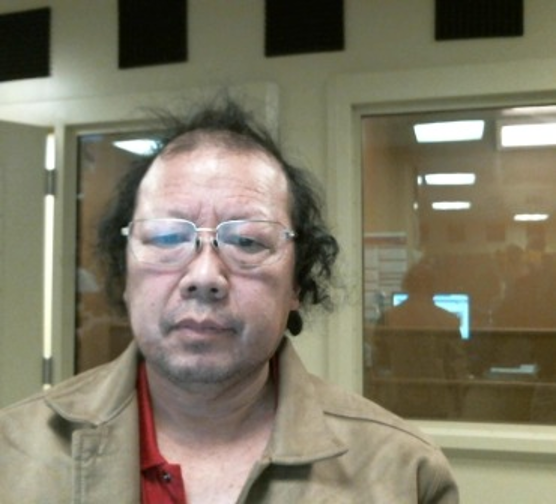

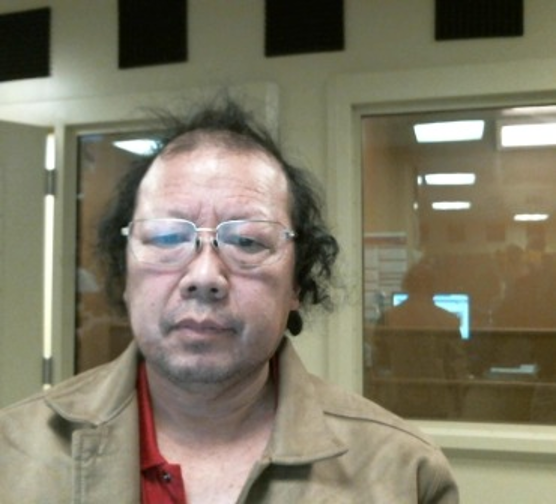

Kou Lor: Subject to a final order of removal since 1996.

Kou Lor, from Laos, is a violent sexual predator who has been convicted of rape with a weapon, rape, statutory rape without force, and sexual assault.

Tou Vang: Subject to a final order since 2006.

Tou Vang, from Laos, is a violent pedophile, with convictions for sexual assault and sodomy of a girl under age 13, and procuring a child for prostitution.

Gilberto Salguero Landaverde: Subject to a final order of removal since 2025.

Gilberto Salguero Landaverde, from El Salvador, is one of a number of recently detained killer migrants, convicted of three counts of homicide.

Ge Yang: Subject to a final order of removal since 2012.

Ge Yang, from Laos, has been convicted of a string of violent and sexual crimes, including strongarm rape, strongarm aggravated assault against a family member, aggravated assault with a weapon, and a domestic violence offense involving strangulation.

Mariama Sia Kanu: Subject to a final order of removal since 2022.

Mariama Sia Kanu, from Sierra Leone, has been convicted of two counts of homicide. She also has four convictions for driving under the influence, three convictions for larceny, and a conviction for burglary.

Sriudorn Phaivan: Subject to a final order of removal since 2018.

Sriudorn Phaivan, from Laos, is an extremely violent pedophile, having been convicted of strongarm sodomy of a boy and strongarm sodomy of a girl. He has also been convicted of a separate aggravated sex offense and nine counts of larceny.

Chong Vue: Subject to a final order of removal since 2024.

Chong Vue, from Laos, has convictions for strongarm rape of a 12-year-old girl and kidnapping a child with intent to sexually assault. He also has a conviction for vehicle theft.

Carlos Flores Miguel: Previously deported from the U.S. on four separate occasions.

Four-time deportee Carlos Flores Miguel is an MS-13 gang member and convicted sex offender, whose record includes assaulting federal law enforcement.

Assistant Secretary Tricia McLaughlin has said of the migrants being arrested in Minnesota, “Many of these public safety threats were released from Minnesota jails. We are calling on Governor [Tim] Walz and [Minneapolis] Mayor [Jacob] Frey to honor the more than 1,360 detainers of the illegal aliens in Minnesota jails.”

Nevertheless, state Democrats, including Walz and Frey, have argued the U.S. Immigration and Customs Enforcement (ICE) action in Minnesota is “a campaign of organized brutality against the people of Minnesota by our own federal government” that is making residents less safe.

Walz characterized ICE agents, whom he has previously compared to the Gestapo, as “going door to door, ordering people to point out where their neighbors of color live,” and “kidnapping innocent people with no warning and no due process.” Meanwhile, Frey has publicly called on ICE to “Get the f**k out of Minneapolis.”

Minnesota Senators Amy Klobuchar and Tina Smith have also attacked ICE, with the former saying, “We need ICE out of Minnesota, they are not making us more safe,” and the latter saying, “Get the f**k out of my town, leave us alone, you are making us less safe, and you need to leave.”

Join Pulse+ to comment below, and receive exclusive email analyses.