In the latest economic projections released Friday, the Congressional Budget Office (CBO) stated the U.S. successfully evaded a recession in 2023. The government agency predicted the U.S. will also likely avoid a recession in 2024, although it does project continued sluggish economic growth for the next year.

The CBO forecasts a 1.5% expansion in real gross domestic product (GDP) for 2024, a decrease from this year’s 2.5% growth, attributing the drop mainly to a deceleration in consumer spending and commercial construction. In the labor market, unemployment rates are predicted to rise slightly from the current 3.9% to 4.4% by the end of 2024, but will still maintain healthy levels with slight workforce growth largely propelled by immigrant labor.

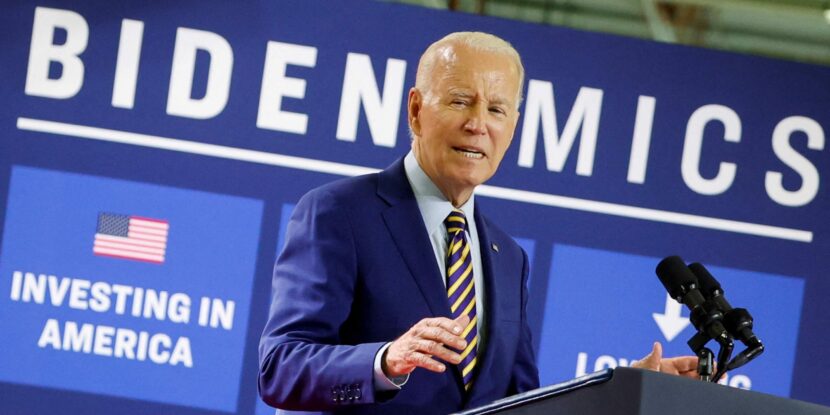

While the economic outlook and avoidance of a recession is mildly positive news, the end of 2024 presents a potential challenge for President Biden when voters head to the polls. At that time, only 45,000 new jobs are projected to be created per month.

The softening labor market is expected to slow inflation, estimated at 2.1% next year, close to the Federal Reserve’s target of 2%. Falling prices could undermine Republican accusations linking Biden’s economic policies to the country’s recent peak inflation period, the highest in 40 years. Inflation rates are projected to slightly increase in 2025 as the economy regains momentum.

The forecast that the U.S. sidestepped a recession in 2023 contradicts earlier predictions by Bloomberg’s economists in 2022 who estimated a 100% likelihood of a recession occurring. Instead, the U.S. reported a substantial increase in real GDP growth from 0.7% in 2022 to 2.5% this year. Despite this positive turn, the CBO has detected a slowdown with real GDP growth currently at 0.8% this quarter, projected to grow to 1.3% in Q1 2025, and achieve a 1.7% annualized quarterly growth by the end of 2024.