Joe Biden’s high-volume immigration policy is driving the rising housing inflation linked to surges in interest and mortgage rates, concedes the Wall Street Journal. Chief economics correspondent Nick Timiraos says one “key reason market rents have moderated is that the industry is adding a record amount of new apartment supply.” However, industry executives advise that “supply is being quickly absorbed because of increased immigration,” among other factors.

The Federal Reserve has been trying to get inflation down to two percent, but an expected slowdown in the cost of housing has not materialized.

“Fed officials, Wall Street investors, and private-sector economists have expected housing inflation to slow since late 2022,” the WSJ reports, adding, “Housing inflation has indeed slowed from a peak of 8.2 percent one year ago – but only to 5.6 percent in March.”

Jay Parsons, Texas-based apartment owner Madera Residential’s head of residential strategy, says this is “a much slower pace than pretty much anybody anticipated.”

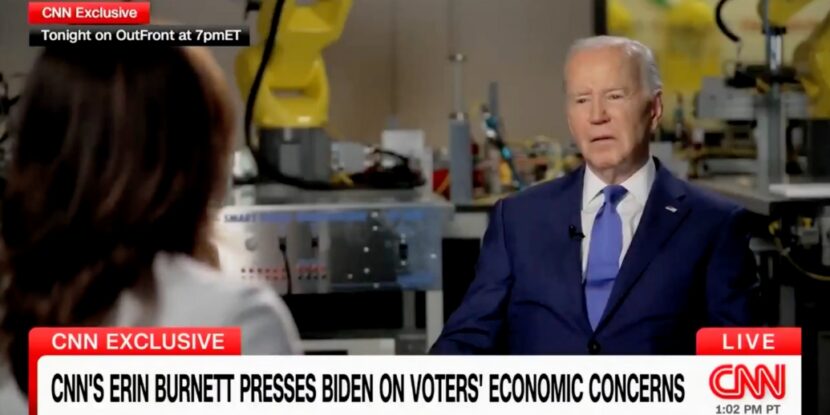

The Biden regime had planned on being able to count on a general improvement in the inflation situation and the economy generally heading into the November elections. However, the situation is poorer than expected, with inflation figures worse than projected and job growth shaky. Research suggests the “American Dream” has become unaffordable to anyone earning less than $100,000 nationwide and, in many states, less than $150,000.

Illegal immigration, in particular, has been extremely high under Biden, with a majority of voters suspecting the Democrat incumbent is allowing it for partisan advantage.

News that immigration is helping keep housing costs, interest rates, and mortgage rates high in the U.S. comes as a report in the United Kingdom confirms record-breaking mass migration has exacerbated housing shortages and is driving rents and house prices upwards.

show less