As the U.S. economy braces itself for the third year of an inflation surge that has substantially hiked the cost of living and sharply depressed real wages, most registered voters believe President Biden’s policies will cause prices to rise.

A poll by CBS News and YouGov released Sunday shows that 55 percent of registered voters believe Biden’s policies will trigger price increases. Only 17 percent of registered voters believe his policies will cause prices to decline. Twenty-seven percent believe his policies won’t impact prices either way, suggesting that 82 percent of voters believe Biden is ineffective at controlling inflation or is actively making it worse.

In comparison, 44 percent of registered voters believe former President Donald Trump’s policies would decrease inflation, and only a third believe his policies would worsen inflation. Sixty-five percent of registered voters said the economy was ‘good’ under Trump, while only 38 percent described Joe Biden’s economy as ‘good.’

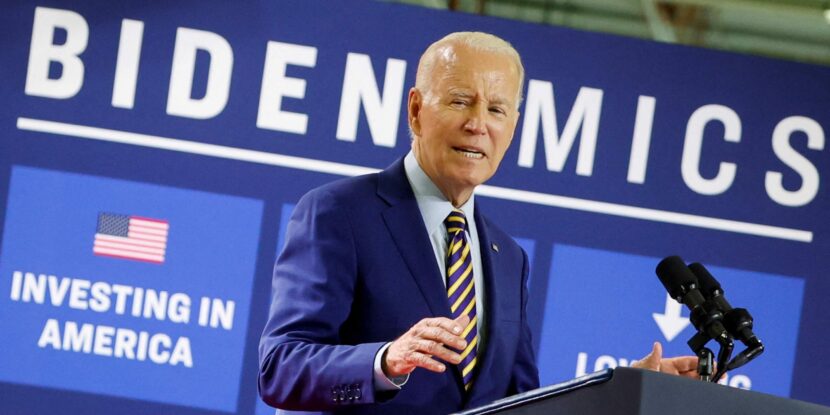

Biden’s handling of the economy has been a persistent weakness for the incumbent president, as a 14,000-word profile published in The New Yorker on Monday highlights. Speaking in an interview for the piece, Biden remarked: “…look, if I didn’t think that the policies I put in place were best for the country, I don’t think I’d be doing it again. I’m running again because I think two things: No. 1, I’m really proud of my record, and I want to keep it going. I’m optimistic about the future. And, secondly, I look out there, and I say, ‘O.K., we’re just—most of what I’ve done is just kicking in now.’ ”

The profile also highlighted polling from January that reveals Americans’ lack of faith in Biden’s ability to steer the economy. “When pollsters asked who would do better in specific areas, the gaps were stark… on the economy, [Trump led Biden] fifty-five to thirty-three.”

show less