❓WHAT HAPPENED: Minnesota mayors are urging state leaders to address budget issues as tax increases loom for residents.

👤WHO WAS INVOLVED: Mayors from multiple Minnesota cities, state officials, and taxpayers.

📍WHEN & WHERE: The letter was published late Monday, with investigations into fraud ongoing in Minnesota.

💬KEY QUOTE: “Fraud, unchecked spending, and inconsistent fiscal management in St. Paul have trickled down to our cities—reducing our capacity to plan responsibly, maintain infrastructure, hire and retain employees, and sustain core services without overburdening local taxpayers.” — Letter from 98 Minnesota mayors

🎯IMPACT: Potential tax hikes and financial strain could affect Minnesota residents significantly if no resolution is reached.

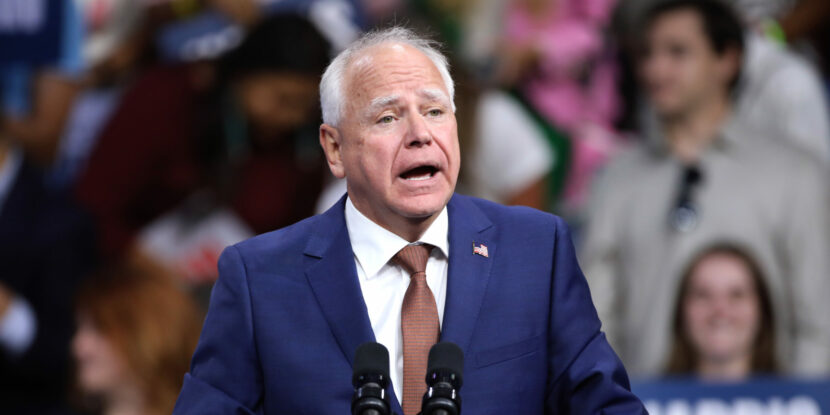

Mayors across Minnesota are urging state leaders to address ongoing budget shortfalls that could result in significant tax increases for residents. A total of 98 mayors are warning that Governor Tim Walz‘s (D) reckless fiscal policy has left local budgets strained and that the state government has turned a $18 billion budget surplus into an estimated $3 billion deficit for the 2028-29 biennium.

Among the top concerns of the local leaders is the Walz administration’s inability to handle a massive and sprawling social services fraud scheme involving Minnesota’s Somali immigrant community. An estimated $9 billion in taxpayer dollars appears to have been stolen through schemes targeting food assistance programs and Medicaid.

“Fraud, unchecked spending, and inconsistent fiscal management in St. Paul have trickled down to our cities—reducing our capacity to plan responsibly, maintain infrastructure, hire and retain employees, and sustain core services without overburdening local taxpayers,” the letter signed by the group of mayors states. “There is a growing disconnect between state-level fiscal decisions and the strain they place on the cities we lead. When the state expands programs or shifts responsibilities without stable funding, it is our residents—families, seniors, businesses, and workers—who ultimately bear the cost.”

“Our state owes it to our citizens to practice responsible fiscal management and to stop taxing our families, seniors, and businesses out of Minnesota. We urge the Legislature to course-correct and to remember that every dollar you manage belongs not to the Capitol, but to the people of Minnesota,” the mayors’ letter adds.

The National Pulse reported on Monday that the House Oversight Committee has expanded its investigation into alleged fraud within Minnesota’s social services programs, issuing requests for interviews with current and former state officials and seeking cooperation from federal agencies. Chairman James Comer (R-KY) sent letters to seven Minnesota officials asking them to participate in transcribed interviews scheduled for late January and early February 2026. The committee also contacted Attorney General Pam Bondi and Treasury Secretary Scott Bessent to request federal assistance with the inquiry.

Join Pulse+ to comment below, and receive exclusive e-mail analyses.